0 results for 'Morvillo Abramowitz Grand'

Determining the Citizenship of Trusts for Diversity Jurisdiction

In this edition of their Southern District Civil Practice Roundup, Edward M. Spiro and Christopher B. Harwood discuss a recent decision in which Magistrate Judge Robert W. Lehrburger recently addressed whether a trust's citizenship depends on the citizenship of its trustee(s), its beneficial owner(s), or both.

Recent Woes for Prosecutors in Cellphone Searches

Three recent district court decisions exemplify how courts have struggled with the Fourth Amendment questions raised by the intrusive nature of cellphone searches.

Establishing a 'Cheek' Defense Through Expert Testimony

In 'Cheek v. United States,' the Supreme Court established the government's burden of proof to show that a defendant acted "willfully" in order to obtain a conviction on criminal tax charges. In this column Tax Litigation Issues, Jeremy H. Temkin analyzes recent circuit court decisions rejecting claims that defendants were improperly deprived of their ability to present a 'Cheek' defense through expert testimony.

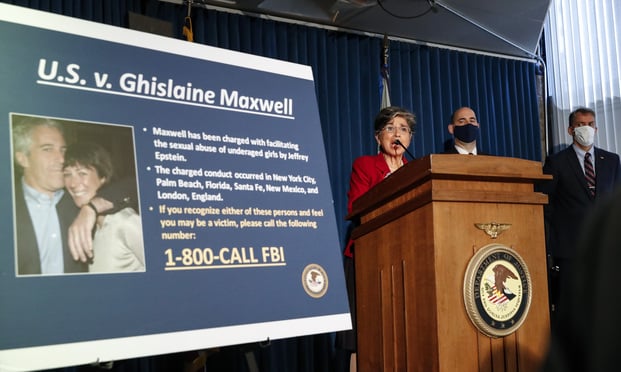

White-Collar Investigations and Disclosure During Corporate Transaction Due Diligence

In this edition of their White-Collar Crime column, Elkan Abramowitz and Jonathan S. Sack discuss 'Schaeffler' and 'Carnegie', which shed light on the scope of the common interest doctrine under federal law and, more specifically, within the Second Circuit.

'Van Buren v. U.S.': A Window Into Criminal Law in Barrett Era?

White-Collar Crime columnists Robert J. Anello and Richard F. Albert discuss the U.S. Supreme Court's recent 'Van Buren' decision, which fits into a pattern of the court's modern criminal law jurisprudence that, while purporting to use only traditional tools of statutory interpretation and to eschew policy judgments, nevertheless appears motivated by concerns about the ever-expanding reach and severity of federal criminal law.

Fried Frank Secures $1.5 Million Contract to Represent NY Health Dept. in COVID Response Probe

The contract indicates that the Manhattan district attorney's office has made inquiries to the state agency, though it is not explicit on local prosecutors' focus.

2nd Circuit Upholds $100,000 in Sanctions Against New York Copyright Attorney

One of the most prolific copyright filers in the country has been ordered to pay a $100,000 fine, serve all of his clients with a copy of the sanctions order and file a copy of it in all of his pending cases for a year.

Will 'CIC Services' Open the Floodgates to Tax Challenges?

In 'CIC Services', the U.S. Supreme Court unanimously rejected the government's argument that the Anti-Injunction Act barred a challenge to an IRS Notice requiring both taxpayers and their advisors to disclose information regarding transactions the government views as abusive on pain of both civil tax penalties and criminal prosecution. In this edition of his Tax Litigation Issues, Jeremy H. Temkin analyzes the decision and considers its ramifications for future challenges to tax-related provisions.TRENDING STORIES

More from ALM

- Legal Speak at General Counsel Conference Midwest 2024: Mike Andolina, Partner, White & Case 1 minute read

- Legal Speak at General Counsel Conference Midwest 2024: Carolyn Burbrink, Uber Director of Volume Mobility Safety and Insurance Litigation 1 minute read

- Legal Speak at General Counsel Conference Midwest 2024: Vaishali Rao, Hinshaw & Culbertson Partner 1 minute read

Resources

Corporate Transparency Act Resource Kit

Brought to you by Wolters Kluwer

Download Now

Revenue, Profit, Cash: Managing Law Firms for Success

Brought to you by Juris Ledger

Download Now

Law Firm Operational Considerations for the Corporate Transparency Act

Brought to you by Wolters Kluwer

Download Now

The Ultimate Guide to Remote Legal Work

Brought to you by Filevine

Download Now