White-collar defense attorneys are commonly engaged to represent companies in government investigations. While such investigations are pending, corporate clients still pursue the usual range of business transactions, including buying or selling a business or borrowing money from a bank or other lender. If a subject of an investigation seeks to borrow money or sell all or part of its business, the lender or buyer will almost certainly seek disclosure of material legal risks, and white-collar defense counsel for the borrower or seller may be called upon by a corporate client to describe an ongoing investigation and give an assessment of its merits.

Several risks flow from such disclosures by counsel. As an initial matter, counsel may feel pressure to provide an assessment that is rosier or simply more definitive than the law or facts known to counsel at the time of the disclosure support. The dangers associated with disclosure are exacerbated by the risk of discovery—either in subsequent civil litigation, or even during the very criminal investigation about which counsel is disclosing information. The government might go to a counterparty and try to find out what counsel for the subject company did and did not say about the facts and likelihood of liability.

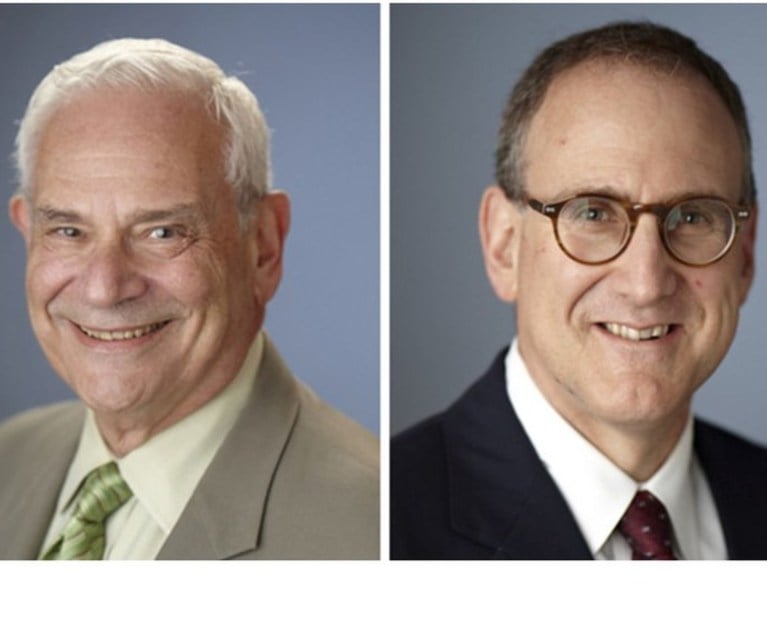

Elkan Abramowitz and Jonathan S. Sack

Elkan Abramowitz and Jonathan S. Sack