The COVID-19 pandemic has been devastating for businesses across the country. Just a few statistics put the pandemic’s rapid and expansive damage into perspective. Initial weekly jobless claims went from 280,000 on March 14 to 6.9 million on March 28. And this trend shows no signs of slowing. Indeed, certain economists and government officials predict that unemployment could reach a staggering 15%, and that our nation’s GDP could fall by as much as 34% between April and June. Nor is there any immediate relief in sight. According to a federal plan for tackling the pandemic, it could last 18 months, with additional outbreaks coming in multiple waves.

In light of these immediate and potentially extended challenges, businesses undoubtedly will—and should—ask themselves whether their commercial property insurance policies provide business interruption coverages for virus-related losses. It seems that for those who already have submitted claims for coverage, their insurers have largely denied those claims as either falling outside the relevant policy’s coverage provisions, or falling within one or more policy exclusions. These coverage denials have sparked a flurry of lawsuits filed by disgruntled policyholders across the country, including at least three proposed class actions. In the coming months, it is reasonable to expect that insurers will face dozens (if not hundreds) more of these coverage actions. Foreseeing as much, two policyholder-plaintiffs even have asked the U.S. Judicial Panel on Multidistrict Litigation to consolidate all these cases going forward, and thereby preclude the possibility of different courts in different states reaching different results with respect to the same key insurance issues.

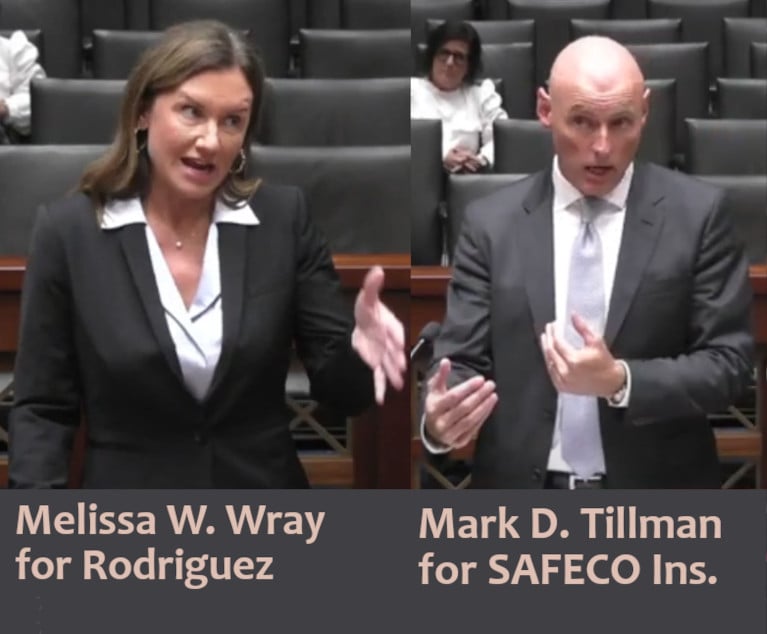

Dennis Windscheffel, Clayton Matheson and Erin Brewer, of Akin Gump Strauss Hauer & Feld. (Courtesy photo)

Dennis Windscheffel, Clayton Matheson and Erin Brewer, of Akin Gump Strauss Hauer & Feld. (Courtesy photo)