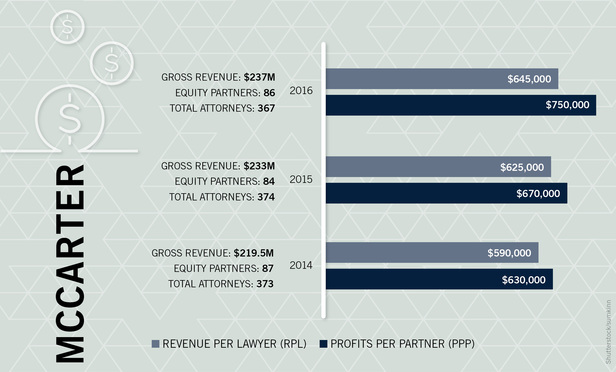

Despite a net loss in attorney population, McCarter & English saw year-over-year revenue improvement while the firm’s profitability metrics increased more dramatically.

The $237 million in gross revenue posted in fiscal 2016 by the Newark-based firm was a 1.7 percent increase from the previous year’s $233 million, according to data compiled by the ALM Legal Intelligence group, a Law Journal affiliate.