Over the past 10 years, this column has detailed the Internal Revenue Service’s aggressive pursuit of taxpayers with undisclosed offshore accounts. In addition to criminal prosecutions, the IRS’s efforts have included the imposition of substantial civil penalties on taxpayers who failed to participate in one of its Offshore Voluntary Disclosure Programs. Based on 2004 legislation, the IRS has long taken the position that taxpayers who fail to disclose accounts on a Report of Foreign Bank and Financial Account, commonly referred to as an FBAR, are subject to a maximum penalty of up to 50 percent of the funds in the undisclosed accounts.

Recently, however, four federal trial courts have considered the extent of the IRS’s authority to assess FBAR penalties, with two courts holding that a regulation adopted in 1987 caps FBAR penalties at $100,000 per account. Two other courts, however, have sided with the IRS, upholding the 50 percent maximum penalty even if it exceeds $100,000; and others are likely to enter the fray. This article analyzes the ongoing debate over the maximum permissible FBAR penalty and its implications.

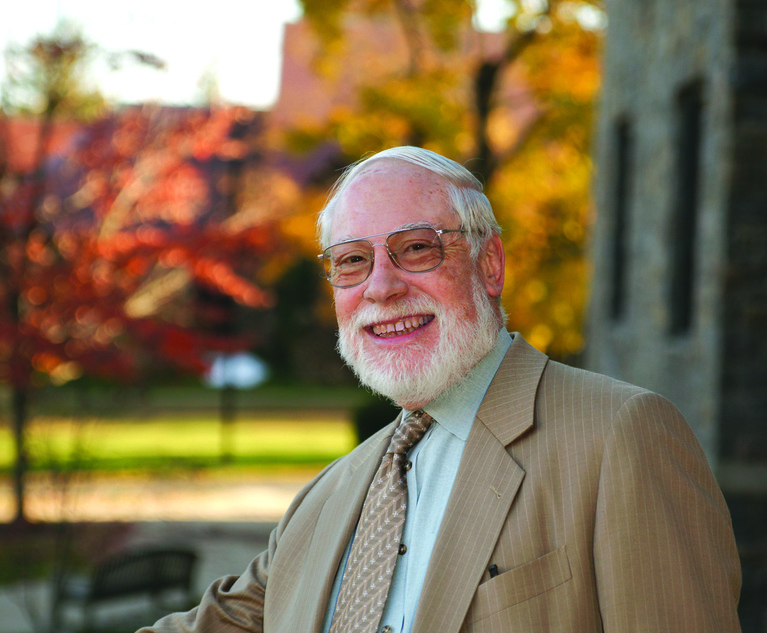

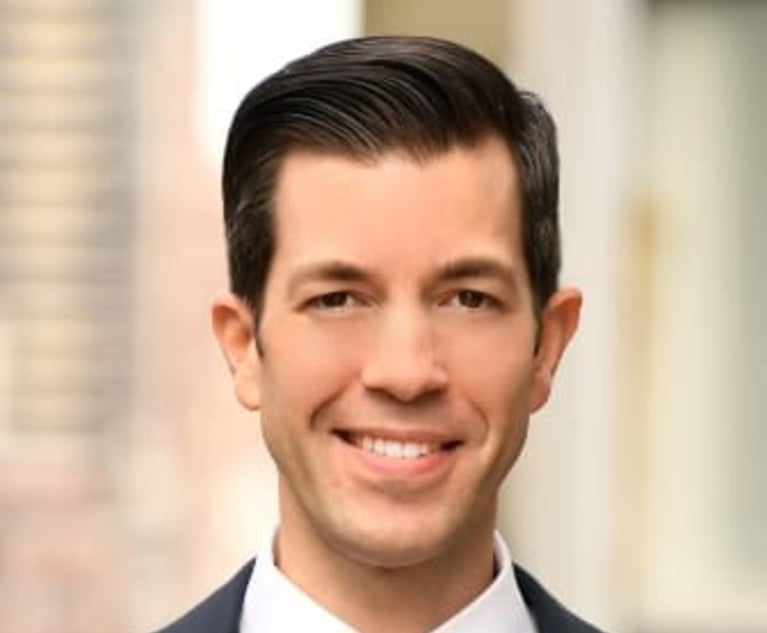

Jeremy H. Temkin

Jeremy H. Temkin