Connecticut Gov. Dannel P. Malloy on Tuesday announced that The Hartford and Liberty Mutual Insurance had agreed to provide additional assistance to customers facing crumbling foundations due to defective concrete.

The companies joined Travelers Companies Inc. in committing funds to supplement benefits already available through the state’s new captive insurance program, known as the Connecticut Foundations Solutions Indemnity Co.

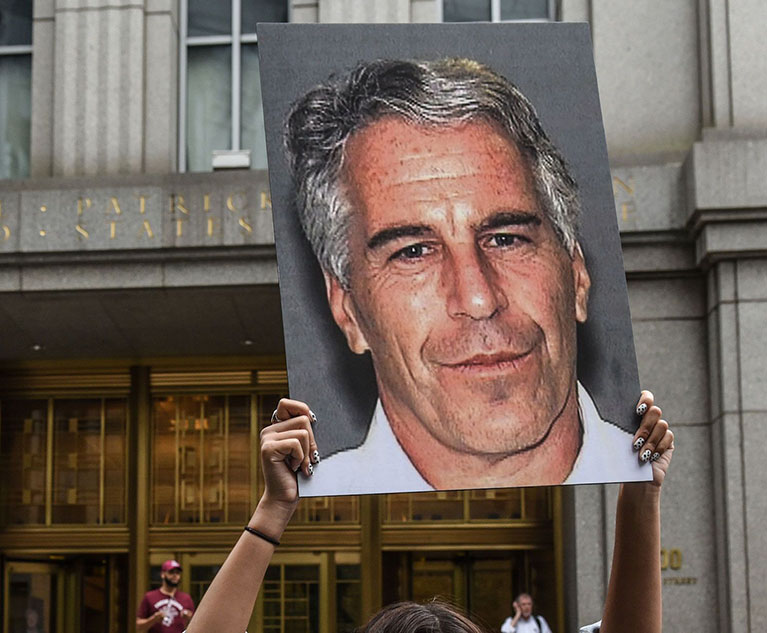

Gov. Dannel P. Malloy of Connecticut (Photo: Peter Foley/Bloomberg)

Gov. Dannel P. Malloy of Connecticut (Photo: Peter Foley/Bloomberg)