Fashion trends come in waves. Apparently, so do law firm management strategies.

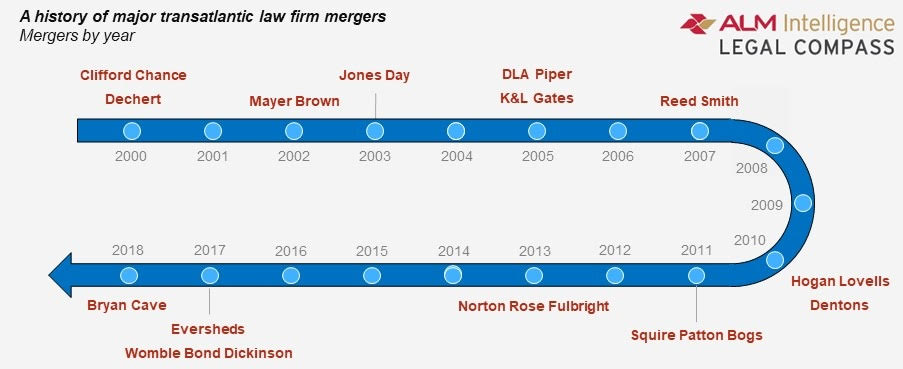

After a busy decade of trans-Atlantic mergers, including 10 combinations of U.S. and U.K. firms between 2000 and 2011, there was a distinct slowdown. Only one major trans-Atlantic merger was completed between January 2011 and February 2017. Then word of the Eversheds Sutherland merger broke. Soon after, rumors began emerging that Womble Carlyle and Bond Dickinson were to merge. Then came news of the Bryan Cave and Berwin Leighton Paisner combination. Beyond those three examples, others have been whispered about, both privately and publicly, as is the case of the rumored merger between Allen & Overy and O’Melveny & Myers. Clearly, something is in the air.