Ahead of the Curve: Bar Exam Security in the Age of the UBE

This week's Ahead of the Curve looks at the recent California bar exam essay topics leak, and whether that could have been prevented if California used the Uniform Bar Exam. Plus, a look at a new private student loan just for Harvard Law School.

August 06, 2019 at 04:21 PM

7 minute read

Welcome back to Ahead of the Curve. I’m Karen Sloan, legal education editor at Law.com, and I’ll be your host for this weekly look at innovation and notable developments in legal education.

This week, I’m examining whether the State Bar of California’s recent bar exam leak could have been avoided if the state used the Uniform Bar Exam—it’s one of 15 that doesn’t. Next up is a look at a new private loan program offered by College Ave Student Loans specifically for students at Harvard Law School that seeks to undercut federal graduate loan rates.

|

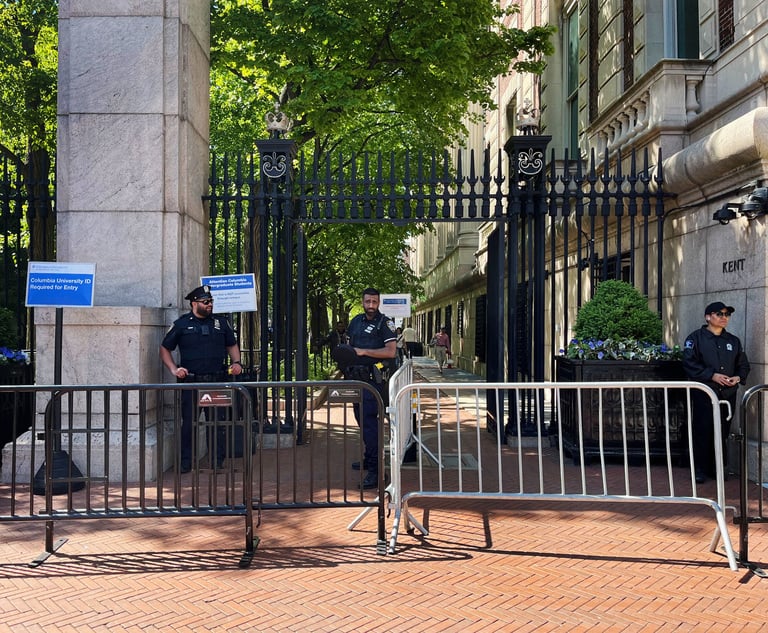

Bar Exam Security in the Age of the UBE

The big story last week was the July bar exam and the State Bar of California’s inadvertent disclosure of the topics of the essay questions. The Cliff’s Notes version of the debacle is that in late July, the bar accidentally revealed those topics to 16 deans of California law schools in an invitation it extended for the deans to observe the grading of the essays. Basically, the bar accidentally sent the invitations out prior to exam, instead of after. So several days later, it decided to disclose those topics to all test takers in an attempt to even the playing field. Still with me?

This got me thinking about the Uniform Bar Exam—which has now been adopted by 35 states—and whether that standard exam offers more security. California is among the notable holdouts not using the UBE, along with Florida and Pennsylvania. (The UBE is composed of the Multistate Bar Exam—the multiple choice part of the test—as well as the Multitstate Essay Exam and the Multistate Performance Test.) Could a leak like this happen in a UBE jurisdiction? To find out, I reached out to Judith Gundersen, president of the National Conference of Bar Examiners, which develops the UBE components. She walked me through the distribution and grading of the essay portion of the test.

But first let me clarify how California’s bar exam differs from the UBE. While it uses the MBE, California develops its own essay questions. So the topics that leaked on the July exam were not the same as the essay topics that bar takers in other jurisdictions encountered on the MEE. But here’s an important point: Each jurisdiction grades its own essay questions, even those that are UBE states using the MEE. In light of that, what I really wanted to find out from Gundersen is whether UBE jurisdictions know the MEE topics ahead of time. To my mind, that is the crux of whether or not a similar leak could happen with the UBE. Here’s what she told me

“UBE jurisdiction administrators are aware of the topics before administration. They are our partners in test security and exam administration. They understand that no one should share information outside of admissions staff or examiners before administration to ensure fairness in testing.”

Gundersen went on to say the NCBE has strict security protocols surrounding the distribution and handling of all its bar exam materials before, during and after the exam.

My thoughts: Becoming a UBE jurisdiction isn’t a silver bullet for avoiding major test screw-ups along the lines of what happened in California. Bar examiners still know the MEE topics ahead of time, and could conceivably leak them in some fashion. But I think there are likely security benefits to adopting the uniform exam. Being subject to the NCBE’s security protocols for each component of the exam probably reduces the chances of an inadvertent slip like the one in California, if only because there are fewer logistics to handle on the jurisdictional level.

That said, improved security is clearly not the primary selling point of the UBE. The big benefit is the portability of the scores earned in UBE jurisdictions. That is, people who take the bar exam in a UBE jurisdiction can use that score to gain admission in any other UBE jurisdiction without having to take the test again. (Each UBE jurisdiction sets its own cut-off score, so candidates must meet that threshold in the state in which they aim to be admitted.)

A Very Specific Loan

There hasn’t been much discussion of private student loan lenders in the legal education sphere since 2010, when the federal government expanded access to graduate-level loans and essentially cornered the law student market. So it caught my eye last week when a relatively new private lender announced a loan program specifically for students at Harvard Law. I was surprised that a private lender is trying to compete with the Education Department on the rates it offers graduate students, and I also found it interesting that this loan is geared to students at a particular law school. That’s not something I can recall seeing before.

Here are the details: The private lender is called College Ave Student Loans, and it was founded in 2014. It has launched the College Ave Harvard Law Program, which gives students at the Cambridge school loans at a fixed 5.9% interest rate. That’s slightly lower than the 6.1% and 7.1% fixed interest rates offered with the Federal Direct Unsubsidized Loans and the Federal Direct GradPlus Loans. A handy calculator on Harvard Law’s website says College Ave’s loan would save students between $346 and $2,113 in interest for every $10,000 they borrow, depending on which type of federal loan is being taken out. The company is also touting its application process, which it says can be completed in just three minutes, as well as the lack of application or loan origination costs. In addition, the loan comes with a nine-month repayment grace period, which is longer than the standard six months, and it can be deferred up to 12 months for those completing clerkships.

Here’s Ken Lafler, assistant dean for student financial services at Harvard Law, which has included College Ave on its short list of preferred lenders.

“Working with lenders to create new, lower-cost loan options for students is just one of the ways Harvard Law School is working to broaden access to a legal education. Combined with increasing amounts of need-based financial aid, as well as the Low Income Protection Plan, we are reducing barriers and making a Harvard Law School education affordable for everyone, regardless of means.”

The takeaway: It makes sense that if a private lender is going to create a loan for a single school, Harvard would be the choice. First, it has a large student body. The school brings in about 600 new students a year. And they’re a relatively safe bet. I don’t know what the default rate is among Harvard Law borrowers, but I’d gamble that it’s pretty darn low. The school has a strong employment track record and attracts whip-smart, ambitious students.

There’s one big negative in my book, though. College Ave’s loans—just like all private loans—aren’t eligible to be forgiven under the Public Service Loan Forgiveness program. (Only certain federal loans qualify.) So it’s a bit of a gamble for students whose career plans may shift during law school.

|

Extra Credit Reading

What does the bar exam of the future look like? The National Conference of Bar Examiners and the Institute for the Advancement of the American Legal System have launched large-scale studies to figure that out.

The law class of 2018 enjoyed the best employment market in a decade, according to new figures from the National Association for Law Placement.

Can legal tech startups transform legal education? Some outfits are trying.

Thanks for reading Ahead of the Curve. Sign up for the newsletter and check out past issues here.

I’ll be back next week with more news and updates on the future of legal education. Until then, keep in touch at [email protected]

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Trending Stories

- 1Infant Formula Judge Sanctions Kirkland's Jim Hurst: 'Overtly Crossed the Lines'

- 2Trump's Return to the White House: The Legal Industry Reacts

- 3Election 2024: Nationwide Judicial Races and Ballot Measures to Watch

- 4Climate Disputes, International Arbitration, and State Court Limitations for Global Issues

- 5Judicial Face-Off: Navigating the Ethical and Efficient Use of AI in Legal Practice [CLE Pending]

- 6How Much Does the Frequency of Retirement Withdrawals Matter?

Who Got The Work

Michael G. Bongiorno, Andrew Scott Dulberg and Elizabeth E. Driscoll from Wilmer Cutler Pickering Hale and Dorr have stepped in to represent Symbotic Inc., an A.I.-enabled technology platform that focuses on increasing supply chain efficiency, and other defendants in a pending shareholder derivative lawsuit. The case, filed Oct. 2 in Massachusetts District Court by the Brown Law Firm on behalf of Stephen Austen, accuses certain officers and directors of misleading investors in regard to Symbotic's potential for margin growth by failing to disclose that the company was not equipped to timely deploy its systems or manage expenses through project delays. The case, assigned to U.S. District Judge Nathaniel M. Gorton, is 1:24-cv-12522, Austen v. Cohen et al.

Who Got The Work

Edmund Polubinski and Marie Killmond of Davis Polk & Wardwell have entered appearances for data platform software development company MongoDB and other defendants in a pending shareholder derivative lawsuit. The action, filed Oct. 7 in New York Southern District Court by the Brown Law Firm, accuses the company's directors and/or officers of falsely expressing confidence in the company’s restructuring of its sales incentive plan and downplaying the severity of decreases in its upfront commitments. The case is 1:24-cv-07594, Roy v. Ittycheria et al.

Who Got The Work

Amy O. Bruchs and Kurt F. Ellison of Michael Best & Friedrich have entered appearances for Epic Systems Corp. in a pending employment discrimination lawsuit. The suit was filed Sept. 7 in Wisconsin Western District Court by Levine Eisberner LLC and Siri & Glimstad on behalf of a project manager who claims that he was wrongfully terminated after applying for a religious exemption to the defendant's COVID-19 vaccine mandate. The case, assigned to U.S. Magistrate Judge Anita Marie Boor, is 3:24-cv-00630, Secker, Nathan v. Epic Systems Corporation.

Who Got The Work

David X. Sullivan, Thomas J. Finn and Gregory A. Hall from McCarter & English have entered appearances for Sunrun Installation Services in a pending civil rights lawsuit. The complaint was filed Sept. 4 in Connecticut District Court by attorney Robert M. Berke on behalf of former employee George Edward Steins, who was arrested and charged with employing an unregistered home improvement salesperson. The complaint alleges that had Sunrun informed the Connecticut Department of Consumer Protection that the plaintiff's employment had ended in 2017 and that he no longer held Sunrun's home improvement contractor license, he would not have been hit with charges, which were dismissed in May 2024. The case, assigned to U.S. District Judge Jeffrey A. Meyer, is 3:24-cv-01423, Steins v. Sunrun, Inc. et al.

Who Got The Work

Greenberg Traurig shareholder Joshua L. Raskin has entered an appearance for boohoo.com UK Ltd. in a pending patent infringement lawsuit. The suit, filed Sept. 3 in Texas Eastern District Court by Rozier Hardt McDonough on behalf of Alto Dynamics, asserts five patents related to an online shopping platform. The case, assigned to U.S. District Judge Rodney Gilstrap, is 2:24-cv-00719, Alto Dynamics, LLC v. boohoo.com UK Limited.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250