In what appears to be the first federal decision finding that the U.S. Securities and Exchange Commission hasn’t shown a digital asset offered in an initial coin offering is a security, a judge in San Diego has turned back a request from the SEC for a preliminary injunction against the backers of the Blockvest ICO.

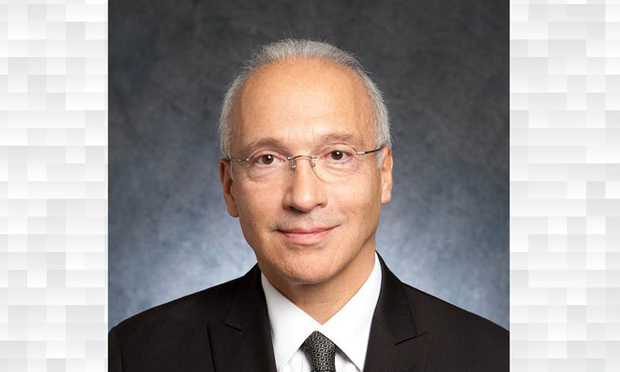

U.S District Judge Gonzalo Curiel of the Southern District of California, who previously granted the SEC’s ex parte request for a temporary restraining order and froze the assets involved in the ICO, found Tuesday that the SEC couldn’t show that investors bought into the Blockvest offering with the expectation of making a profit from the efforts as others—part of the three-part “Howey” test for the definition of a security under the the 1946 U.S. Supreme Court decision in SEC v. W.J. Howey Co.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

LexisNexis® and Bloomberg Law are third party online distributors of the broad collection of current and archived versions of ALM's legal news publications. LexisNexis® and Bloomberg Law customers are able to access and use ALM's content, including content from the National Law Journal, The American Lawyer, Legaltech News, The New York Law Journal, and Corporate Counsel, as well as other sources of legal information.

For questions call 1-877-256-2472 or contact us at [email protected]

U.S. District Judge Gonzalo Curiel.

U.S. District Judge Gonzalo Curiel.