In a particularly harsh opinion, U.S. District Judge Lynn Hughes of Houston denied an appeal by a former Chapter 7 bankruptcy trustee who challenged his removal from all 12 of his cases after the lawyer billed an estate $3,486 for his family’s four-night trip to New Orleans— a “breach of trust” that the judge wrote could not be explained away by “poor judgment.”

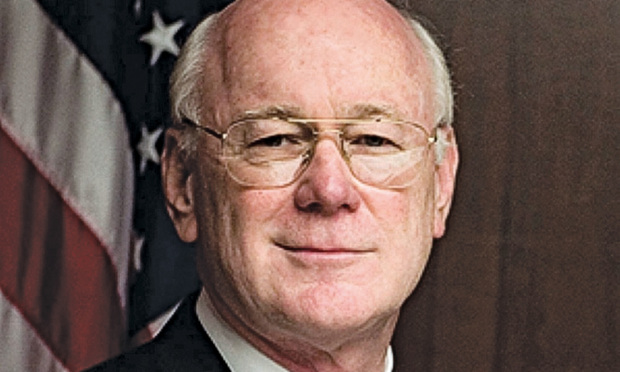

“Poor judgment can come in a variety of forms. Overpleading, excessive depositions and weak coordination are poor judgment. Defalcation—not losing it to inefficiency—purloining estate funds is poor judgment, but it is of a distinct character. Staying in an expensive hotel might be poor judgment, but staying in an expensive one in a vacation town when you are not needed is categorically worse,” Hughes wrote in the August 11 opinion denying W. Steve Smith’s appeal to retain his trustee position.