It’s helpful in times like these for leadership teams to have a common understanding of what’s going on in the broader economy, its implications for law firm demand and a road map for how to tackle the difficult decisions ahead. The following offers such a framing.

Let’s start with the economy. We’ve entered a recession. We can think of it as ultimately having one of three shapes:

- V-shaped: workers stay home causing a dip in economic output; the dip is followed relatively quickly by a recovery in which workers put in overtime to make up for lost productivity; the economy regains its pre-dip trajectory in a matter of weeks.

- U-shaped: the above initial dip in economic output is accompanied by a decline in consumer demand reflecting, among other issues, a contraction in household wealth (home values, retirement assets, etc.); the policy makers take responsive fiscal and monetary measures and economic activity returns to pre-dip growth rate in a matter of months.

- L-shaped: the recession starts out as U-shaped, but the policy interventions prove ineffective and the dip is prolonged into quarters and years.

We experienced a V-shaped dip and recovery with SARS in 2002-03. However, SARS and COVID-19 are very different. When SARS had run its course, there had been a total of 668 cases and 89 deaths outside of China; with COVID-19, the comparable numbers are already over 45,000 and 1,500. Thus, a V-shaped recovery is a best-case scenario.

A U-shaped recession would be similar to that following the 2008 global financial crisis. The U.S. government increased its debt from 65% to 80% of GDP, and the Fed Funds rate was cut from 5% to effectively zero. The recession officially lasted 18 months, December 2007 to June 2009.

An L-shaped recession, as worse than the global financial crisis, may seem a needlessly bleak scenario to consider. It belongs on the set of possibilities because of the differences between 2008 and today in the starting points for any policy actions. U.S. government debt is currently at 105% of GDP (Q3, 2019), as compared with 65% in 2008, making increasing government borrowing more problematic. Similarly, on March 15, the Fed cut its headline rate to 0.25%, leaving no room for further cuts.

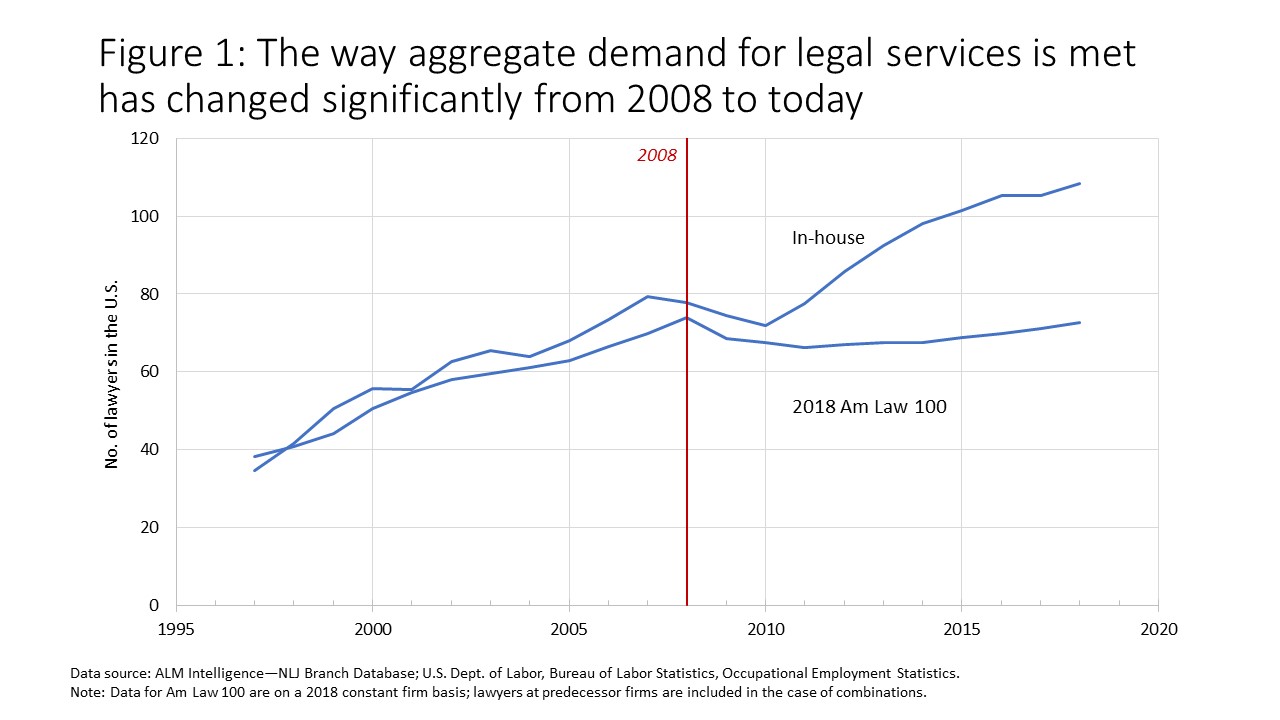

Whatever the shape of the broader economic recession, the effect on law firm demand will be an exaggerated response to it. This was the case in 2008 but it will be even more so this time. This is because of the change since then in how aggregate demand for legal services is met between in-house counsel and outside firms.

Going into the last recession, there were roughly equal numbers of lawyers in the United States who worked in-house and at Am Law 100 law firms. Since then the number of in-house lawyers has grown 40% while that of the Am Law 100 is essentially at the 2008 level, see Figure 1. As the economic recession reduces aggregate demand for legal services, we can expect in-house lawyers to focus first on keeping themselves busy, passing to outside counsel only that work which they truly cannot handle in-house. Parenthetically, we can also expect that, for the work they do send outside, they’ll look for considerable price relief.

Law firm leaders don’t need to take a stance on the ultimate shape of this recession. They can let it reveal itself over time. However, they need to do three things now. Firstly, support clients in their immediate difficulties—e.g. form a task force to ensure all major clients are being contacted by senior firm representatives and offered help in any way possible, both professional and personal, to navigate the short-term exigencies.

Secondly, they need to be ready with targeted initiatives to stoke demand. One example: set aside a virtual budget for key client investment initiatives and have time charged to this budget carry the same internal standing as full-priced client work; another example: reset the parameters deemed acceptable by the pricing committee in order to win major matters.

Thirdly, there are set of capacity and cost issues to address now so as to be able to act quickly and decisively as events unfold. Examples of these include:

- Equity partner transitions: the frothy market of the last several years has kept occupied many partners who will not be able to keep themselves adequately busy at the right price point in a U- or L-shaped recession. Laterals probably warrant particular attention.

- Income partner transitions: the income partner ranks at some firms became a holding ground for executing lawyers who can be valuably employed when business is robust but for whom there isn’t a long-term business case as a partner and who may be blocking the advancement prospects of others.

- Overhead cost management: firms should review their cost structures, distinguishing between those line items that are ‘demand’ side (e.g. marketing, business development) and ‘supply’ side (e.g. recruiting events). The former should be retained or increased; the latter should be reduced or deferred (e.g. IT systems upgrades). Indeed, firms may want to freeze immediately all supply-side admin hiring.

- Terminate flailing growth initiatives: the market exuberance of recent years has facilitated a wait-and-see attitude on certain investments for which there truly isn’t a reason to wait.

- Deferral of incoming associate class: determine now when the decision will be made and, if deferred, what alternatives would be offered, e.g. firm-subsidized furloughs at pro bono organizations?

- Curtail the length of the summer program: again, determine now when the decision will be made.

The coming months portend to be very difficult on numerous fronts. It falls on firm leaders to engage now in the difficult but necessary work that will enable them steer their organizations to safer seas. Delay merely limits options.

Hugh A. Simons is formerly a senior partner and executive committee member at The Boston Consulting Group and chief operating officer and policy committee member at Ropes & Gray. He welcomes reader reactions at [email protected].

NOT FOR REPRINT

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.