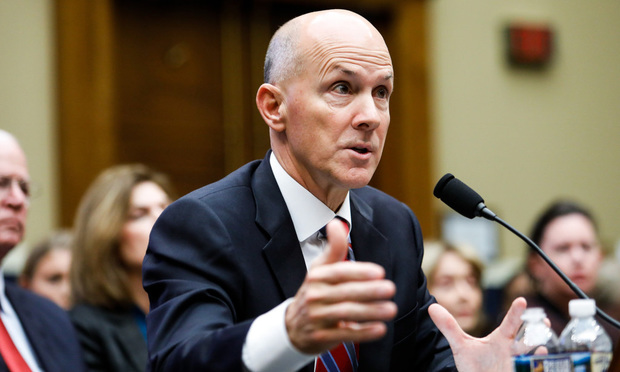

On July 31, just 48 hours after Equifax’s chief executive officer was alerted to what the Atlanta-based credit bureau would soon learn was a breathtaking data breach, it enlisted the help of King & Spalding and the law firm’s data security team, former CEO Richard Smith testified at a hearing Tuesday.

But despite retaining the firm and its data security experts, Equifax waited more than a month before on Sept. 7 notifying the public that hackers had accessed personal and financial information for about 145.5 million consumers, Smith testified Tuesday before the House Subcommittee on Digital Commerce and Consumer Protection.