In 2010, the former owners of the Peter Cooper Village and Stuyvesant Town (Stuy Town) property defaulted on their mortgage. Five years later, that property was sold at a profit that paid off outstanding principal and interest. Litigation then ensued over the allocation and distribution of certain excess proceeds from the sale.

In In re Trusts Established under Pooling and Servicing Agreements Related to Wachovia Bank Commercial Mortgage Trust Pass-Through Certificates, Appaloosa Investment LP and Palomino Master Ltd. (collectively, Appaloosa), an investor in the Stuy Town property, brought claims against CWCapital Asset Management LLC (CWC), the servicer of the trusts in which Appaloosa had invested. Appaloosa asserted that, under the pooling and servicing agreement (PSA), the excess funds should be provided to investors. CWC asserted that those funds should instead be used to pay “penalty interest” and “yield maintenance”, which CWC was required to pay under the PSA.

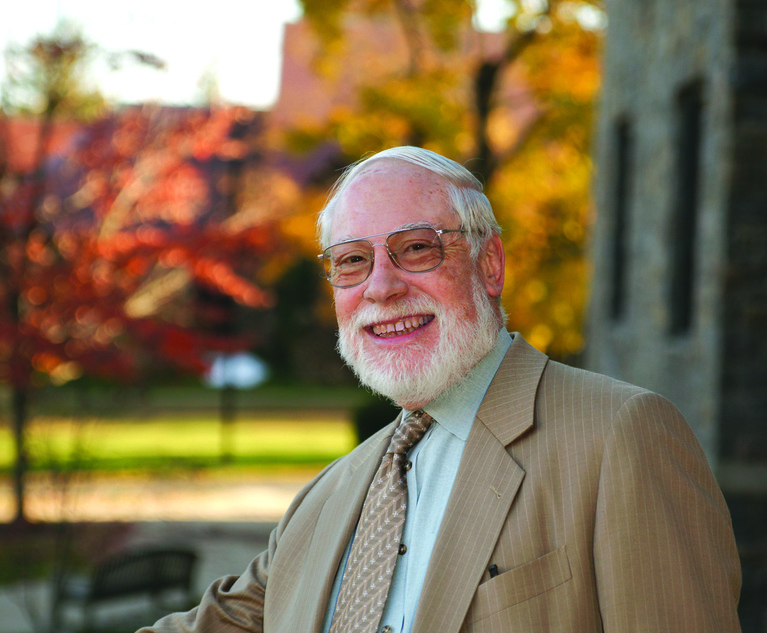

Thomas E. L. Dewey

Thomas E. L. Dewey