Occasionally a client, concerned about having to pay interest on a potential tax deficiency, asks whether it makes sense to report and pay additional tax in the first instance (for example, by not taking a position on his tax return that may be challenged by the Tax Division) and then later file an amended tax return to claim a refund of the additional tax paid.

Almost all tax practitioners (including the authors) generally advise against such approach. Stated simply, the state does not like to give refunds and will frequently take any conceivable position to avoid paying one.

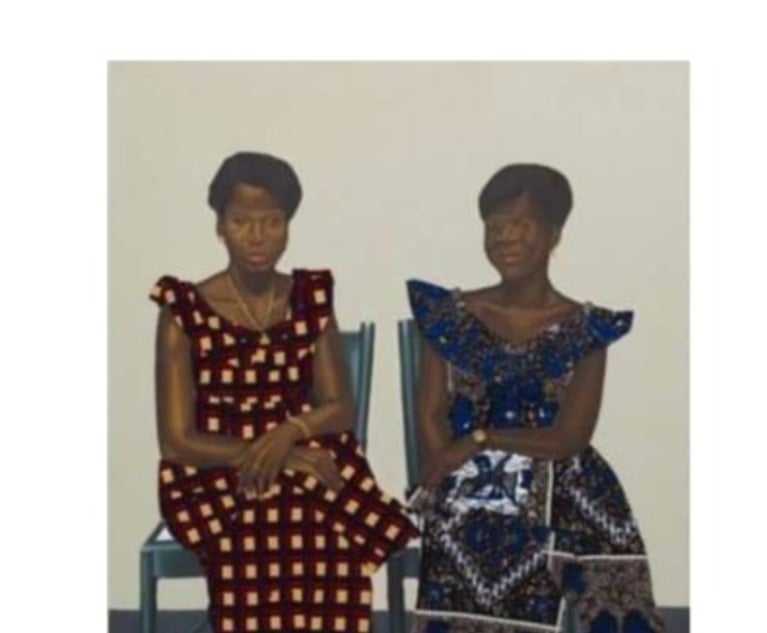

Credit: Deemerwha studio/Shutterstock.

Credit: Deemerwha studio/Shutterstock.