Dearest Readers, the mortgage lending Ton (not quite Regency era society, but close) is abuzz over the Foreclosure Abuse Prevention Act (FAPA) and its potential impacts on mortgage foreclosures.

You may recall these authors’ 2022 NYLJ column discussing Freedom Mortg. Corp. v. Engel, 37 N.Y.3d 1, 169 N.E.3d 912, reargument denied, 37 N.Y.3d 926, 169 N.E.3d 1229 (2021) Engel which held that where the debt had been validly accelerated by virtue of the commencement of a foreclosure action, a lender’s voluntary discontinuance of the foreclosure action constituted an “affirmative act” (which is required if there is no provision in loan documents setting forth the procedure for revocation) deaccelerating the loan and as a result, tolling the six-year period during which lenders must commence a mortgage foreclosure action.

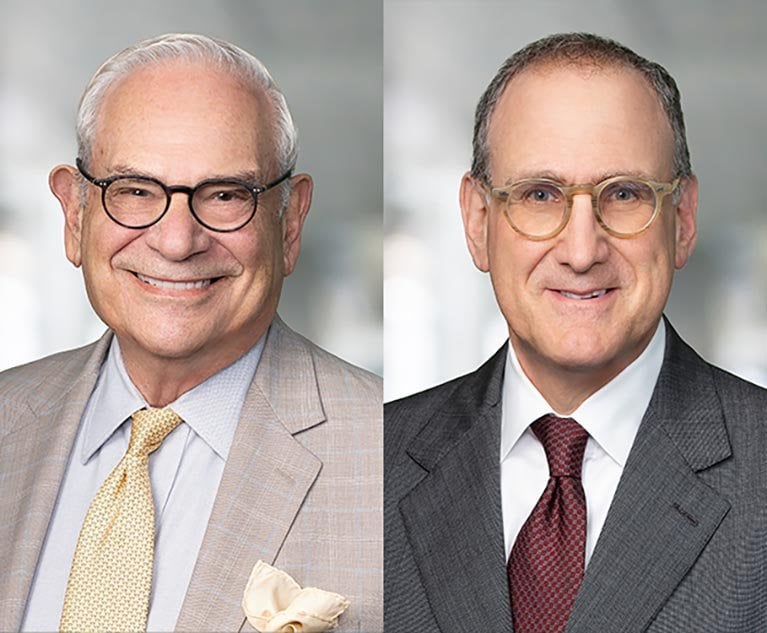

Jeffrey Steiner, left, and Megan Vallerie.

Jeffrey Steiner, left, and Megan Vallerie.