On Thursday, Nov. 21, 2019, the U.S. Court of Appeals for the Second Circuit heard argument in United States v. Blaszczak—an insider trading case that could upend decades of judicial precedent defining the crime of insider trading. Much ink has been spilled over the fact that there is no statute specifically outlawing insider trading. Instead, 40 years of judicial precedent has attempted to define when trading on material nonpublic information constitutes a “fraud” under the catchall antifraud provision of the Securities Exchange Act of 1934, Section 10(b) and SEC Rule 10b-5 (referred to herein as Title 15). Title 15 has been interpreted to require the government to prove that a tipper disclosed material nonpublic information in breach of a fiduciary duty and in exchange for a “personal benefit.” The personal benefit test originated in the Supreme Court case Dirks v. SEC, 463 U.S. 646 (1983), but the element has come into sharp focus in recent years following the Second Circuit’s 2014 decision in United States v. Newman, 773 F.3d 438 (2d Cir. 2014), which tried to introduce a more stringent personal benefit test. Although Newman’s holding has been substantially overruled by the Supreme Court, (see Salman v. United States, 137 S.Ct. 420 (2016)), as being in contravention of Dirks, as well as subsequent Second Circuit decisions (see United States v. Martoma, 894 F.3d 64 (2d Cir. 2017)), the uncertainty surrounding the personal benefit requirement has created problems for prosecutors and defense lawyers alike. This “shoddy state of American insider-trading law,” as a former U.S. Attorney for the Southern District of New York has decried, has led to the creation of a task force whose mission is to craft a workable insider trading statute. Preet Bharara & Robert Jackson Jr., Insider Trading Laws Haven’t Kept Up With the Crooks, N.Y. Times, Oct. 9, 2019. (One of this article’s authors, Katherine Goldstein, is a member of the Bharara Task Force on Insider Trading.) In the meantime, government prosecutors are attempting to circumvent the personal benefit element altogether by charging alleged insider trading under the wire and securities fraud statutes in Title 18 of the U.S. Code.

United States v. Blaszczak marks the first time the Second Circuit will have the opportunity to address whether the government can criminally prosecute insider trading under Title 18 without proving personal benefit to the tipper since the element was imposed on Section 10(b) by the Supreme Court in Dirks. In Blaszczak, the tipper, a government employee, and tippees were charged with violating both Section 10(b) and with wire and securities fraud under 18 U.S.C. §§1343 and 1348. Although not discussed herein because it will have application only to political intelligence cases where the information emanates from the government, the Department of Justice also charged conversion of government property in violation of 18 U.S.C. §641.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

LexisNexis® and Bloomberg Law are third party online distributors of the broad collection of current and archived versions of ALM's legal news publications. LexisNexis® and Bloomberg Law customers are able to access and use ALM's content, including content from the National Law Journal, The American Lawyer, Legaltech News, The New York Law Journal, and Corporate Counsel, as well as other sources of legal information.

For questions call 1-877-256-2472 or contact us at [email protected]

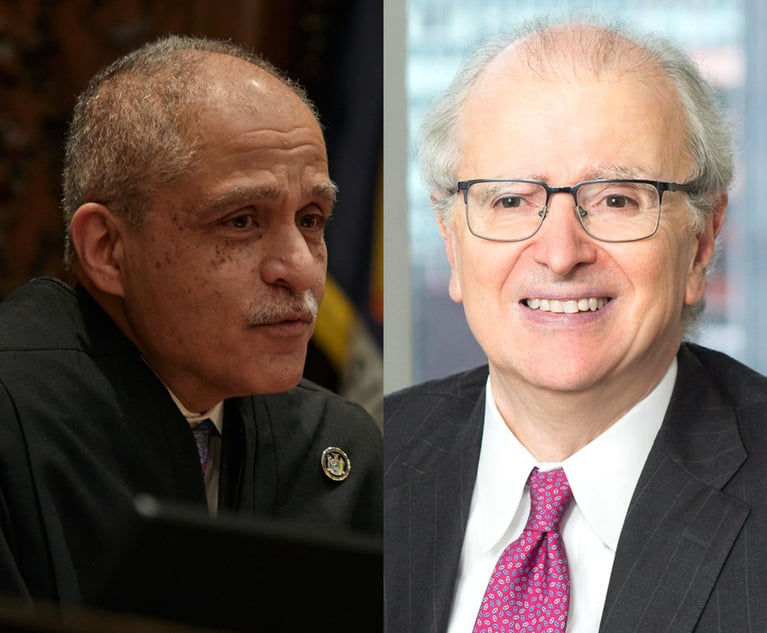

Antonia Apps and Katherine Goldstein

Antonia Apps and Katherine Goldstein