First authorized by the Supreme Court in United States v. Bisceglia, 420 U.S. 141 (1975), and subsequently codified by Congress at §7609(f) of the Internal Revenue Code, John Doe summonses have long been a powerful tool in the IRS’s arsenal to combat tax fraud schemes. These summonses enable the IRS to seek data on a class of otherwise unidentified persons (e.g., customers of a specific bank) where it can articulate a reasonable basis to believe that individuals within that class have failed to comply with their tax obligations.

As this column has recounted, in recent years the IRS has expanded its use of John Doe summonses to investigate tax evasion through cryptocurrency and even to help foreign governments identify individuals using credit cards issued in the United States to evade their tax obligations to their home countries. See Jeremy H. Temkin, Tax Enforcement, John Doe Summonses and Digital Currency, N.Y.L.J. (Jan. 19, 2017); Jeremy H. Temkin, Closed for Business: Shutting Down the U.S. as an Offshore Tax Haven, N.Y.L.J. (May 19, 2019). While practitioners should anticipate the IRS will continue to accelerate its use of John Doe summonses, a recent decision by the U.S. District Court for the Western District of Texas demonstrates some of the obstacles recipients of such summonses face in attempting to avoid compliance.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

LexisNexis® and Bloomberg Law are third party online distributors of the broad collection of current and archived versions of ALM's legal news publications. LexisNexis® and Bloomberg Law customers are able to access and use ALM's content, including content from the National Law Journal, The American Lawyer, Legaltech News, The New York Law Journal, and Corporate Counsel, as well as other sources of legal information.

For questions call 1-877-256-2472 or contact us at [email protected]

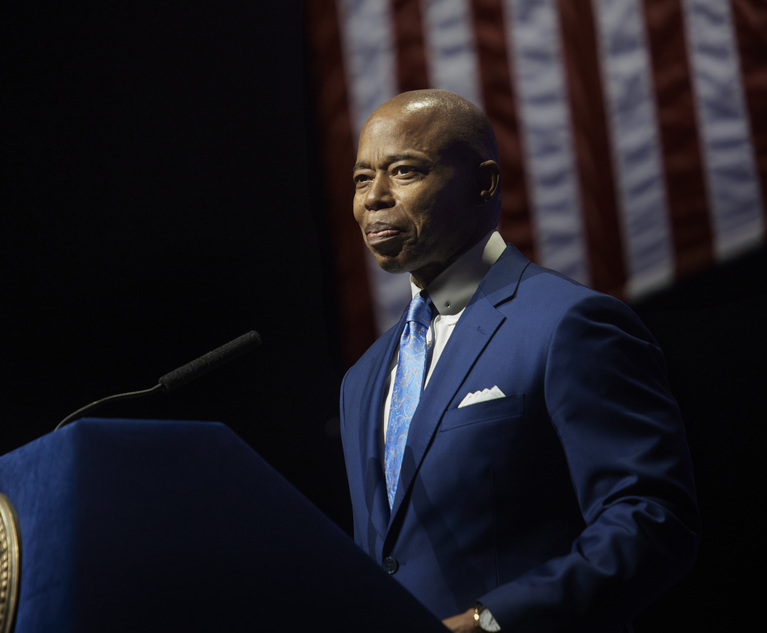

Jeremy H. Temkin

Jeremy H. Temkin