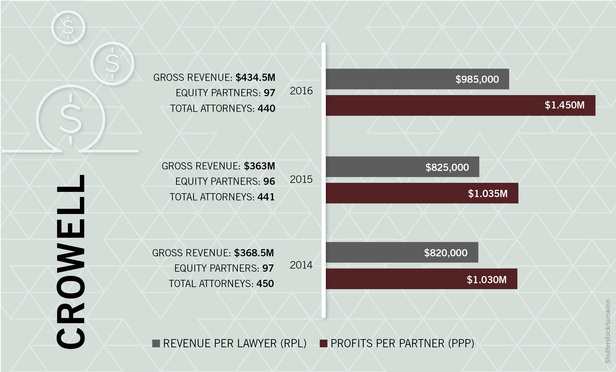

Crowell & Moring partners enjoyed an uncommonly good year in 2016. “They hated it,” chairwoman Angela Styles joked about partners’ responses to the firm’s big gains in both revenue and profits.

The firm posted a 20 percent boost in revenue for 2016, and profits per equity partner (PPP) jumped 40 percent.