Attorneys suing Atlanta-based credit bureau Equifax on behalf of consumers and financial institutions in a massive class action stemming from the firm’s 2017 data breach want documents and witness statements the company turned over to Congress.

On Wednesday, less than 24 hours after a congressional committee released a 96-page report finding the breach was preventable, plaintiffs lawyers filed a motion asking for the materials that served as the basis for that report.

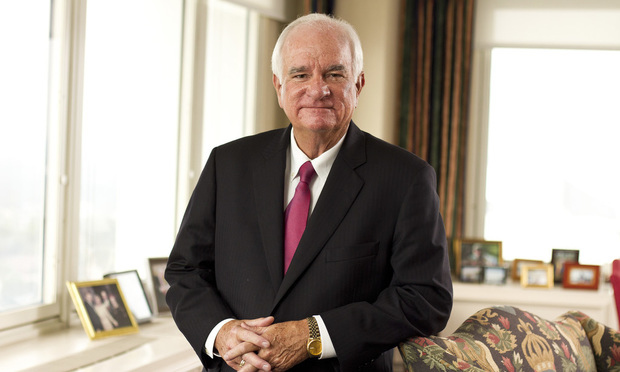

Chief Judge Thomas Thrash Jr. of the U.S. District Court for the Northern District of Georgia is presiding over the case. (Photo: John Disney/ ALM)

Chief Judge Thomas Thrash Jr. of the U.S. District Court for the Northern District of Georgia is presiding over the case. (Photo: John Disney/ ALM)