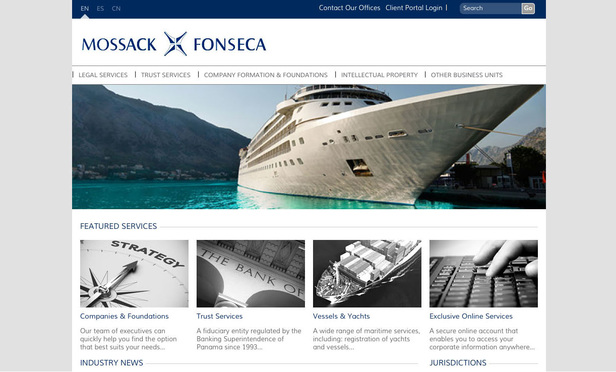

Ten months after a hacking scandal hit one of Panama’s top law firms, pulling back the veil of secrecy covering the offshore legal work, prosecutors in the Central American country have arrested Mossack Fonseca name partners Ramon Fonseca Mora and Jurgen Mossack in connection with a massive bribery case.

The allegations involve offshore accounts that permitted Brazilian conglomerate Odebrecht SA to perpetrate a corruption scheme throughout the Americas. Odebrecht and one of its 12 business units, petrochemical company Braskem SA, agreed in December to pay $2.6 billion in one of the largest settlements in the U.S. under the Foreign Corrupt Practices Act. Quinn Emanuel Urquhart & Sullivan and Paul Hastings had key roles in shepherding that landmark deal, according to sibling publication the New York Law Journal.