Amid a yearslong legal malpractice suit against Wachtell, Lipton, Rosen & Katz, lawyers for the storied New York firm and CVR Energy Inc., a Sugar Land, Texas-based company controlled by Carl Icahn, are now asking a federal judge to settle a heated deposition dispute in which the famed corporate raider bristled at Wachtell’s questioning, leading to its abrupt end.

“I don’t think you have a right to come in and ask me questions. Why don’t you say how are you getting along with your wife, and we can discuss that now?” Icahn told Wachtell’s counsel in the deposition, according to a letter filed in federal court. Icahn was responding to a Wachtell question about a controversial topic for the activist investor—renewable energy policy—which CVR’s counsel charged was ”completely irrelevant” to the suit and invoked in bad faith.

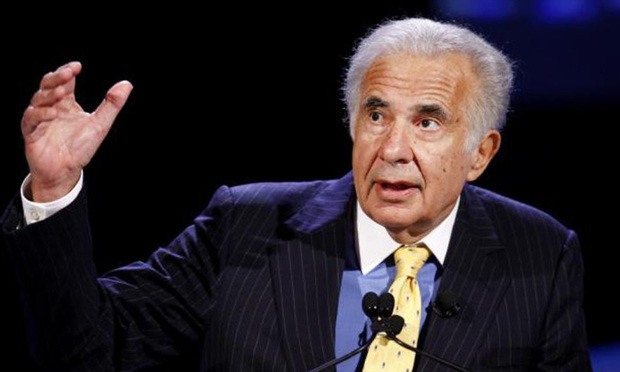

Carl Icahn

Carl Icahn