When does a token become a security? It’s a question that courts, the SEC and startups are tackling on an increasingly frequent basis.

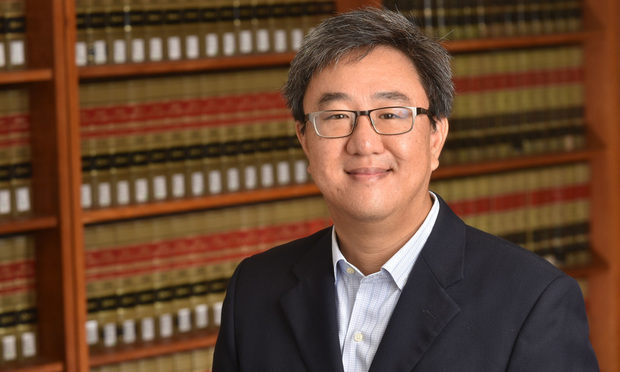

Now taking a swing at an answer is UCLA School of Law Professor James Park, who is the Faculty Director of the Lowell Milken Institute, a securities expert who recently tackled the sticky question of the regulatory status of cryptocurrency in a newly released policy report from the institute, ”When Are Tokens Securities? Some Questions from the Perplexed.”

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

LexisNexis® and Bloomberg Law are third party online distributors of the broad collection of current and archived versions of ALM's legal news publications. LexisNexis® and Bloomberg Law customers are able to access and use ALM's content, including content from the National Law Journal, The American Lawyer, Legaltech News, The New York Law Journal, and Corporate Counsel, as well as other sources of legal information.

For questions call 1-877-256-2472 or contact us at [email protected]

Professor James Park of UCLA School of Law. Photo by Jason Doiy

Professor James Park of UCLA School of Law. Photo by Jason Doiy