In the personal injury world, and in particular workers’ compensation cases, workers’ compensation Medicare set-aside arrangements (WCMSAs), better known as “Medicare set-asides” (MSAs) are an issue few lawyers enjoy dealing with. But how they are accounted for and dealt with in connection with clients’ settlements will have a significant impact on clients’ future medical care and their financial situations.

Earlier this year, the Centers for Medicare & Medicaid Services (CMS) issued new guidelines regarding MSAs that sent shockwaves through the workers’ compensation community. While CMS clarified those new guidelines within a few months, injured workers and their advocates still face uncertainty about what CMS requires when it comes to MSAs.

An MSA Primer

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

LexisNexis® and Bloomberg Law are third party online distributors of the broad collection of current and archived versions of ALM's legal news publications. LexisNexis® and Bloomberg Law customers are able to access and use ALM's content, including content from the National Law Journal, The American Lawyer, Legaltech News, The New York Law Journal, and Corporate Counsel, as well as other sources of legal information.

For questions call 1-877-256-2472 or contact us at [email protected]

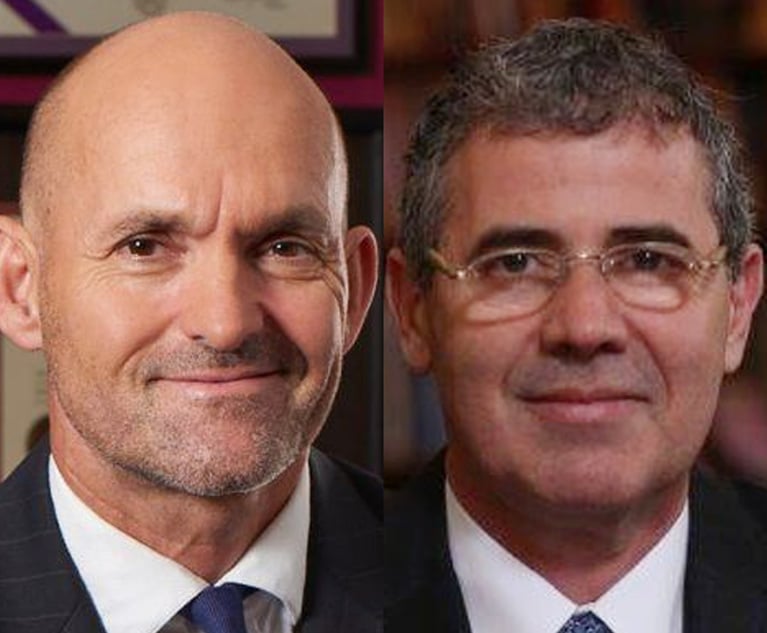

Keld Wenge of Pond Lehocky Giordano LLP. Courtesy photo

Keld Wenge of Pond Lehocky Giordano LLP. Courtesy photo