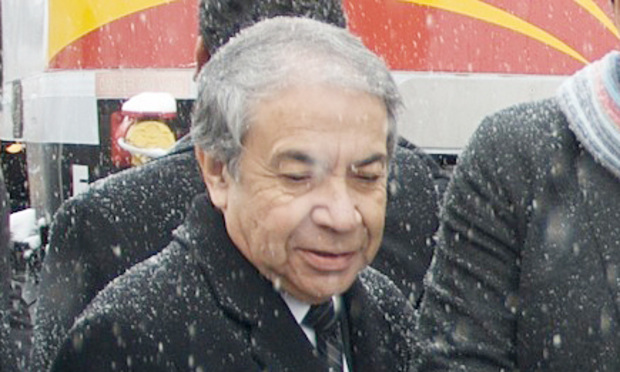

The former governor and attorney general of New Mexico settled fraud charges brought by the U.S. Securities and Exchange Commission stemming from his role as head of a company that the agency said was secretly controlled by two ex-crooks.

Toney Anaya, governor of New Mexico from 1983 to 1987 and attorney general of the state from 1975 to 1978, was charged in an administrative complaint filed Wednesday by the SEC, which also sued three other men and suspended trading in the company. Anaya, credited by the SEC with extensive cooperation, is barred from participating in any offering of a penny stock for at least five years and may still face financial penalties.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

LexisNexis® and Bloomberg Law are third party online distributors of the broad collection of current and archived versions of ALM's legal news publications. LexisNexis® and Bloomberg Law customers are able to access and use ALM's content, including content from the National Law Journal, The American Lawyer, Legaltech News, The New York Law Journal, and Corporate Counsel, as well as other sources of legal information.

For questions call 1-877-256-2472 or contact us at [email protected]