Details of Lantern Capital Partners’ stalking-horse bid to buy Bob and Harvey Weinstein’s namesake film studio came into focus early Tuesday, just hours after The Weinstein Co. filed for Chapter 11 bankruptcy protection in Delaware.

According to court documents, the Dallas-based private equity firm is offering to take on some of the debt left by the production company—which was plunged into dire financial straits in the wake of serial revelations about Harvey Weinstein’s sexual misconduct—and pay $310 million in cash to acquire its legacy assets, which include a television business and library of 277 films. The studio said in the filings that it expects to see $151 million in net cash flows for its catalog of movies in 2018, and revenue for its TV division is projected to hit $255 million.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

LexisNexis® and Bloomberg Law are third party online distributors of the broad collection of current and archived versions of ALM's legal news publications. LexisNexis® and Bloomberg Law customers are able to access and use ALM's content, including content from the National Law Journal, The American Lawyer, Legaltech News, The New York Law Journal, and Corporate Counsel, as well as other sources of legal information.

For questions call 1-877-256-2472 or contact us at [email protected]

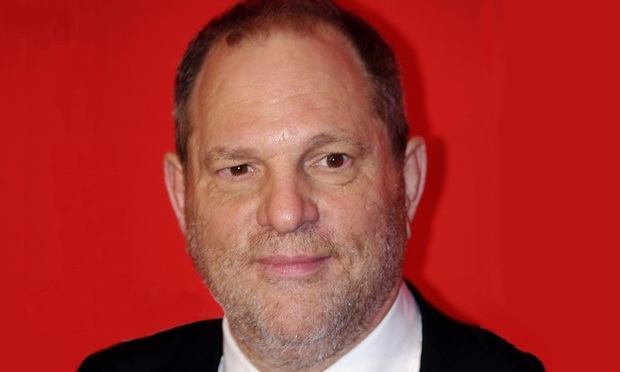

Harvey Weinstein. Photo credit: David Shankbone

Harvey Weinstein. Photo credit: David Shankbone