Exxon Mobil Corp. will boost spending on new oil wells and other projects by as much as 45% after posting the biggest profit in almost eight years amid a broad rally in energy prices.

Net income adjusted for one-time items was $2.05 a share, according to a statement on Tuesday, 12 cents above the average of analyst estimates compiled by Bloomberg. Full-year capital spending will jump to $21 billion to $24 billion from $16.6 billion in 2021. The shares rose as much as 1.9% in pre-market trading.

The results come a day after Exxon disclosed yet another belt-tightening move, this time involving shuttering its corporate headquarters in suburban Dallas and consolidating those offices near Houston. Exxon shares have risen more than 20% this year, capping an almost 50% advance in 2021 for the best annual performance in at least four decades.

Natural gas sales provided the primary uplift in fourth-quarter results as Exxon and other suppliers reaped hefty returns amid fuel shortages across Europe and parts of Asia. Escalating oil prices also proved a boon to the Western world’s largest crude explorer.

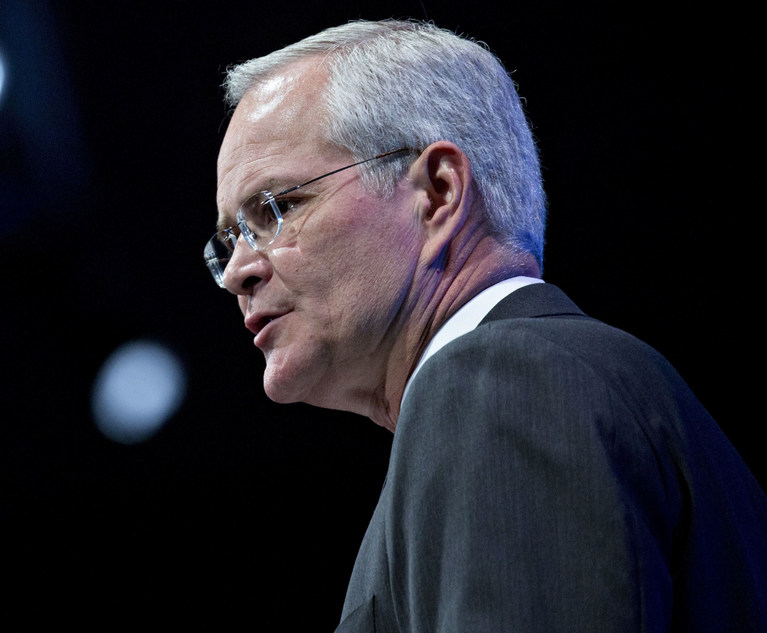

Chief Executive Officer Darren Woods’ decision to reverse course on a pre-pandemic growth plan and hold capital spending at historically low levels means high commodity prices are translating directly into massive cash flow.

While some observers have raised concerns about Exxon’s long-term commitment to fossil fuels, in the near term the company is profitably harvesting older reserves and replacing them with high-margin barrels from new discoveries in places such as Guyana.

In 2021, Exxon garnered ample cash to repair its balance sheet, pay the S&P 500 Index’s third-largest dividend and pledge to restart share buybacks. It’s a remarkable financial turnaround for the oil giant a year after it incurred its first annual loss in at least 40 years during the darkest days of the pandemic.

Exxon is under pressure to do more on climate change, especially after activist investor Engine No. 1’s success last year. Its recently announced ambition to eliminate emissions from its operations by 2050 is one step in that direction but the company will also have to allocate more cash to its low-carbon business over time, especially in areas like carbon capture and biofuels.

Kevin Crowley reports for Bloomberg News.

NOT FOR REPRINT

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

Darren Woods, chairman and chief executive officer of Exxon Mobil Corp. Photo: Andrew Harrer/Bloomberg

Darren Woods, chairman and chief executive officer of Exxon Mobil Corp. Photo: Andrew Harrer/Bloomberg