As professionals whose careers have spanned decades of dealing with issues associated with bankruptcy, turnaround and insolvency situations, we believe that we are in the midst of a significant crisis with respect to the integrity of municipal bonds. Based upon our professional experience, we fear that the failure of municipal entities, which includes cities, towns, counties, hospital districts, water districts, etc., to take immediate action in light of the consequences of the coronavirus pandemic will seriously jeopardize the ultimate payment of outstanding municipal bonds. Since much uncertainty still remains with respect to the level of federal support municipalities may garner, it is unlikely the support will be adequate to offset the significant revenue shortfalls that municipalities have incurred and will continue to incur until economic activity returns to its pre-COVID 19 levels. Elected officials and their administrative executive teams must act now to not only assess their current financial situation, but they must also initiate contingency plans to curtail an insolvency situation and mitigate the impact of the shortfalls. The organizations with the most proactive, experienced and creative teams are most likely to prevail and survive.

Since this may be the first time that the finance team members for the municipalities have ever faced a situation of this magnitude, many municipalities and other organizations need to benefit from the inclusion of experienced turnaround and restructuring professionals to bolster their teams and rely on the expertise of these professionals to assist in navigating through the crisis. With the recent announced furloughs of police, fire and other municipal employees by the city of Miramar within Broward County, and with the Chapter 11 filing of the municipal bond financed student housing project in Gainesville, we believe that these actions are the proverbial tip of the iceberg of the financial tsunami that will impact municipalities, hospital districts, school districts and other Florida projects financed with municipal bonds. Bond rating agencies are making daily announcements concerning the downgrading of previously highly rated (AAA) municipal bonds as a result of the pandemic.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

LexisNexis® and Bloomberg Law are third party online distributors of the broad collection of current and archived versions of ALM's legal news publications. LexisNexis® and Bloomberg Law customers are able to access and use ALM's content, including content from the National Law Journal, The American Lawyer, Legaltech News, The New York Law Journal, and Corporate Counsel, as well as other sources of legal information.

For questions call 1-877-256-2472 or contact us at [email protected]

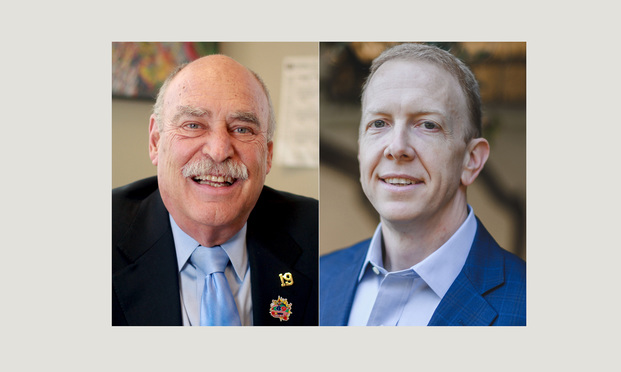

Charles Tatelbaum and Shelby Faubion

Charles Tatelbaum and Shelby Faubion