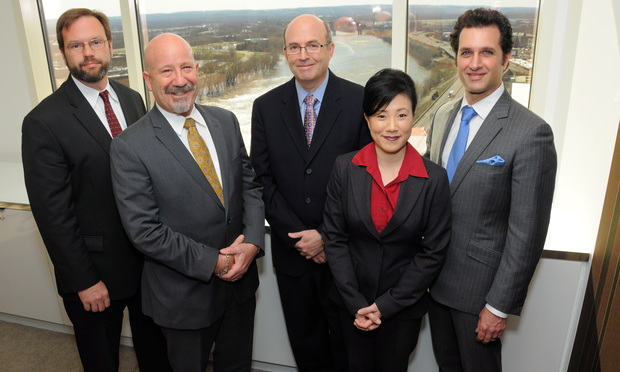

Bingham McCutchen may only have eight litigators in its Connecticut office. But they insist there’s no shortage of staff or resources for the cases they handle both in and out of state. After all, there are 450 total Bingham McCutchen litigators worldwide.

And just because the eight Connecticut lawyers happen to be in Hartford, that doesn’t mean they’re not working on a complex case originating from another part of the country.