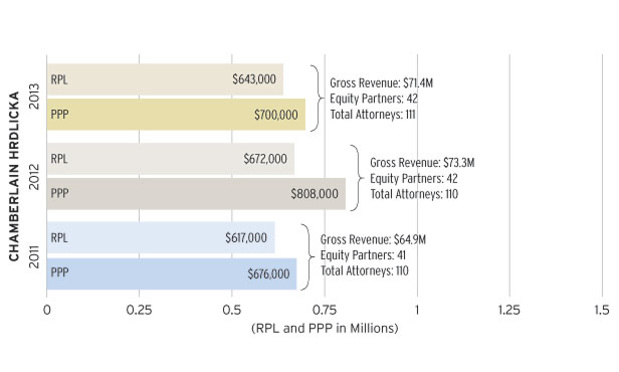

Chamberlain, Hrdlicka, White, Williams & Aughtry, a Texas-based firm with a Pennsylvania presence, is projecting a rebound in 2014 after seeing declines in gross revenue, profits per equity partner and revenue per lawyer in 2013.

In 2013, the firm’s gross revenue decreased 2.5 percent from $73.3 million in 2012 to $71.4 million in 2013, and the revenue per lawyer (RPL) also dropped 4.3 percent from $672,000 in 2012 to $643,000 in 2013, according to numbers provided by the firm. The profits per equity partner (PPP) was also reported to have dipped approximately 13 percent from $808,000 in 2012 to $700,000 in 2013.