Larger bond issues but fewer of them—that’s the general takeaway from New Jersey’s public finance market this year, which again included a significant number of refinancings of existing government debt.

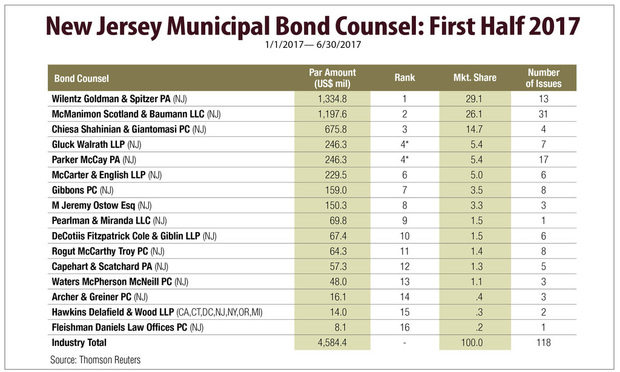

The list of active bond counsel included mostly familiar names, though the firms occupying the top two spots last year traded places: Wilentz, Goldman & Spitzer of Woodbridge is No. 1, and McManimon, Scotland & Baumann of Roseland is No. 2.