There are many important traits that make a good attorney. As a trusts and estates lawyer, flexibility is among these key attributes. We serve different roles for each client and provide the specific services that are required for every unique matter. There is also an ever changing landscape of legal tools, technology and evolving laws requiring a need to adapt to new circumstances on a regular basis.

As estate planning attorneys, we are taking that concept of flexibility and building it into our client’s estate plans. That is because the estate tax laws are in a period of significant flux. Most recently, the Tax Cuts and Jobs Act of 2017 (TCJA) essentially doubled the federal estate tax exemption. In 2017, each U.S. individual had an exemption from federal estate taxes of $5.49 million. However, because of the TCJA, the exemption in 2018 skyrocketed to $11.18 million, and has steadily increased for inflation each year since (with the 2024 exemption set to be $13.61 million).

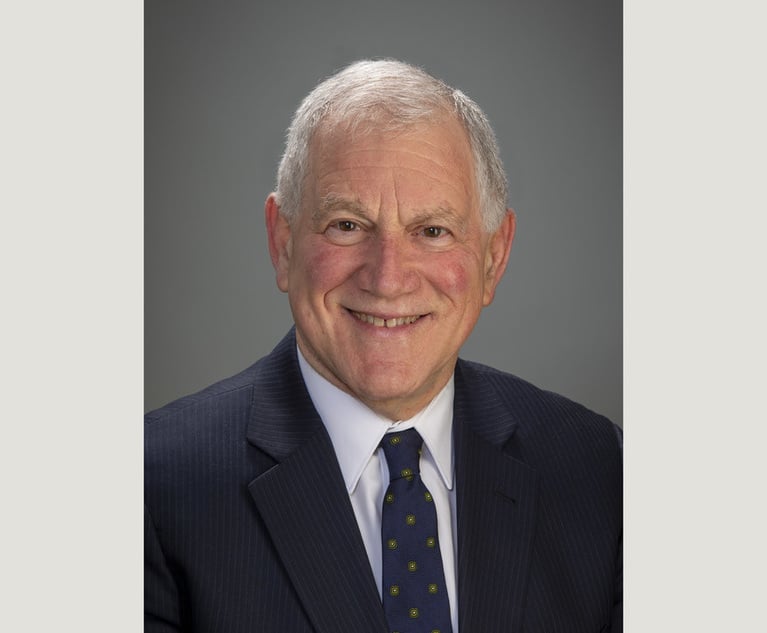

Michael Schwartz, Chair of the Trusts and Estates Law Section of the New York State Bar Association. Courtesy photo

Michael Schwartz, Chair of the Trusts and Estates Law Section of the New York State Bar Association. Courtesy photo