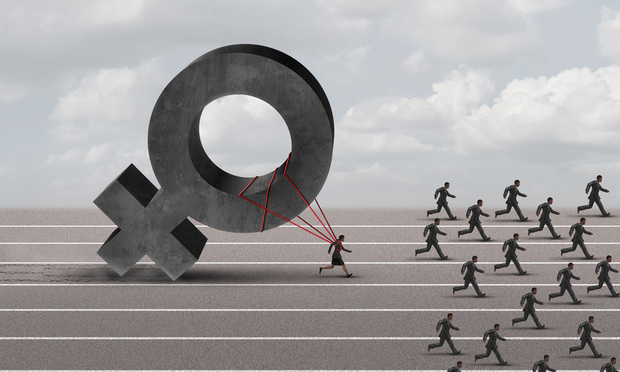

Employers faced with navigating the wave of new and potential legislation directed at remediating pay equity issues would be wise to proactively to address the issue. While it may seem obvious, none of the applicable laws prohibit pay differentials outright; instead, all laws prohibit pay differentials only when they are attributable to impermissible factors. A properly structured pay equity audit can serve to identify only those differentials that are potentially unlawful, and tacitly approve of those differentials that are permissible.

Each employer may have different goals for an audit, different ideas concerning the appropriate focus of the audit, and different resources to be contributed to the audit, all of which prevent a “one size fits all” approach to describing an audit. Nevertheless, five features will be integral across all efforts.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

LexisNexis® and Bloomberg Law are third party online distributors of the broad collection of current and archived versions of ALM's legal news publications. LexisNexis® and Bloomberg Law customers are able to access and use ALM's content, including content from the National Law Journal, The American Lawyer, Legaltech News, The New York Law Journal, and Corporate Counsel, as well as other sources of legal information.

For questions call 1-877-256-2472 or contact us at [email protected]

Pay-Equity

Pay-Equity