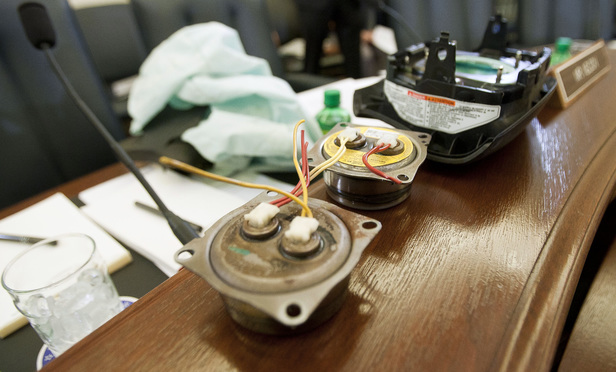

Takata Corp., a Japanese automotive parts manufacturer subject to the largest product recall in history over its once faulty air bags, filed for bankruptcy on Sunday in Tokyo and Delaware.

The move comes five months after Takata agreed to pay $1 billion in criminal penalties to settle charges filed by the U.S. Department of Justice related to its sale of defective air bags. Civil multidistrict litigation in Florida will continue without its lead defendant, although plaintiffs’ lawyers had already taken into consideration the likelihood of Takata’s eventual insolvency. And now bankruptcy lawyers from dozens of large firms are entering the fray.