For many Americans, a trip abroad conjures up images of scenic vistas, Roman ruins or Parisian cafes. For U.S.-based businesses, however, doing business abroad is often less idyllic. Complicated four-character acronyms threaten operations at every turn. Often lost in the sea of European-based regulations is the second Payment Services Directive (PSD2). Understandably, many companies have focused much more on compliance with the General Data Protection Directive (GDPR) than on PSD2. But with less than a year until full PSD2 compliance is required, it is time for merchants to prepare.

- PSD2 Alphabet Soup

PSD2 is the second attempt by the European Commission to regulate the rights and obligations of payment services users and payment services providers (PSPs). Among the directive’s aims is to level the playing field for PSPs, offer better consumer protection and improve payment efficiency in the European Union. Accordingly, all the parties in the payment landscape— consumers, banks, FinTech companies, and merchants—are impacted by PSD2.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

LexisNexis® and Bloomberg Law are third party online distributors of the broad collection of current and archived versions of ALM's legal news publications. LexisNexis® and Bloomberg Law customers are able to access and use ALM's content, including content from the National Law Journal, The American Lawyer, Legaltech News, The New York Law Journal, and Corporate Counsel, as well as other sources of legal information.

For questions call 1-877-256-2472 or contact us at [email protected]

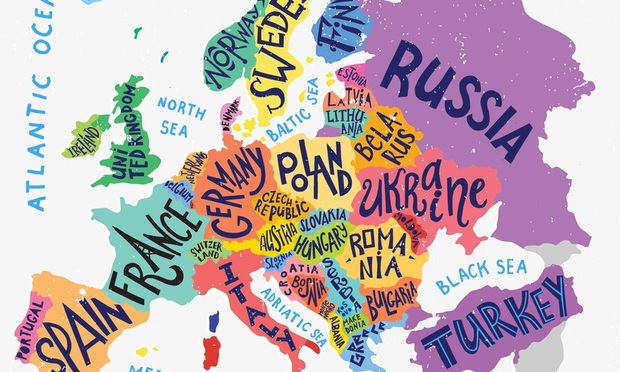

Europe map

Europe map