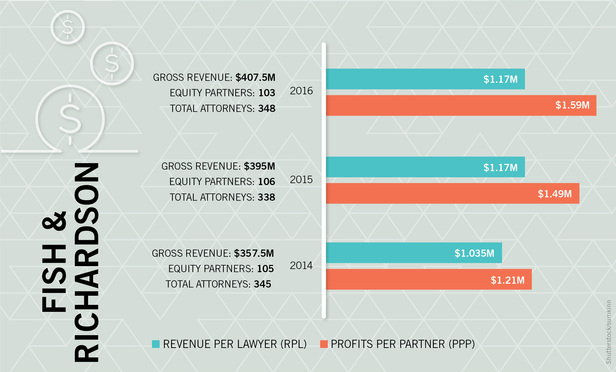

A significant increase in contingency fee income helped Fish & Richardson continue its growth in 2016, with the firm posting solid gains in both revenue and profit.

The Boston-based firm didn’t quite hit the heights of 2015, when a huge IP litigation caseload saw it achieve double-digit growth across all metrics. But Fish CEO Peter Devlin told The American Lawyer that it was still a “really strong year across the board,” with contingency fees leaping from $11.8 million to $31.4 million.