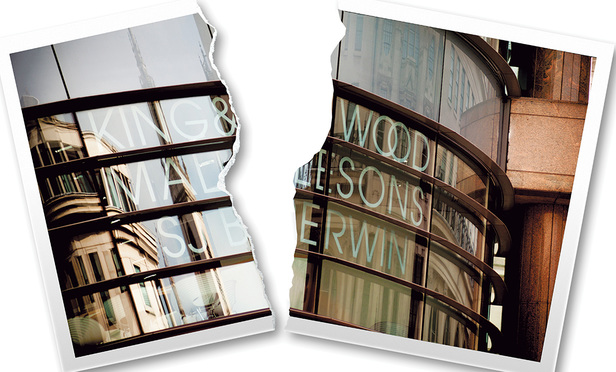

The unraveling of King & Wood Mallesons’ grand global experiment has been both sudden and dramatic.

Just over three years ago, London-based SJ Berwin joined forces with King & Wood Mallesons—itself the product of a merger between China’s King & Wood and Australia’s Mallesons Stephen Jacques—in a pioneering deal. The first-ever combination of leading practices in Asia and London was supposed to create an entirely new breed of international law firm, one that would have unrivaled access to lucrative outbound work for major Chinese corporations.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

LexisNexis® and Bloomberg Law are third party online distributors of the broad collection of current and archived versions of ALM's legal news publications. LexisNexis® and Bloomberg Law customers are able to access and use ALM's content, including content from the National Law Journal, The American Lawyer, Legaltech News, The New York Law Journal, and Corporate Counsel, as well as other sources of legal information.

For questions call 1-877-256-2472 or contact us at [email protected]