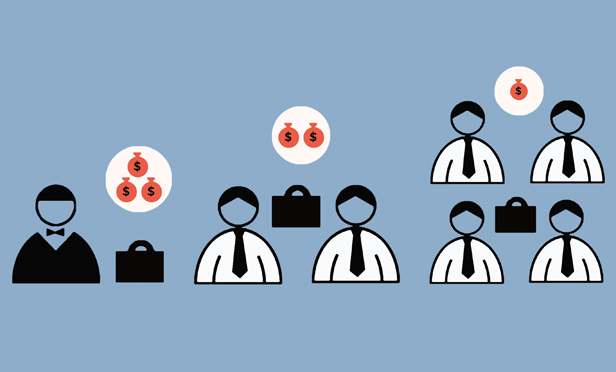

Consider two workers at the same company. They have the same title. They bill clients at the same rate. But one is paid a third of what the other’s paid. You might suggest that the lower-paid worker engage the services of an employment lawyer and that their clients be tipped off to the trick. Except that the workers are lawyers—at most Am Law 100 firms, in fact, where profits per equity partner are, on average, $1.47 million, compared with $451,801 for nonequity partners.

Not only is the practice business as usual, it’s fallout from the biggest firm management trend of the past two decades—the creation of the two-tier partnership. Twenty years after The American Lawyer began to track nonequity partners, we decided to take a tape measure to the ever-expanding tier and consider its consequences for law firm health.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

LexisNexis® and Bloomberg Law are third party online distributors of the broad collection of current and archived versions of ALM's legal news publications. LexisNexis® and Bloomberg Law customers are able to access and use ALM's content, including content from the National Law Journal, The American Lawyer, Legaltech News, The New York Law Journal, and Corporate Counsel, as well as other sources of legal information.

For questions call 1-877-256-2472 or contact us at [email protected]