Last year, Governor Brown signed legislation to prevent employers from asking about or relying on salary history information when making hiring decisions. That legislation, Assembly Bill 168 from Assemblymember Susan Talamantes Eggman went into effect on Jan. 1, 2018. The bill raised a number of questions among employers, especially regarding key terms that were undefined, vague or unclear.

Acknowledging these concerns, Assemblymember Eggman introduced a follow-up measure, Assembly Bill 2282, to define some key phrases and provide further guidance to California employers.

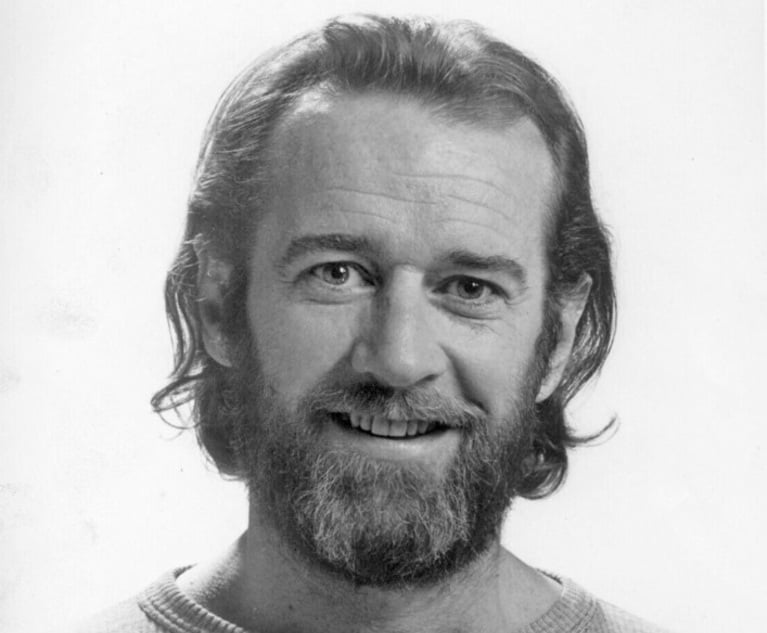

Benjamin M. Ebbink, Of Counsel with Fisher Phillips in Sacramento (Photo: Courtesy photo)

Benjamin M. Ebbink, Of Counsel with Fisher Phillips in Sacramento (Photo: Courtesy photo)