There’s lawyering up and then there’s this: Cybercurrency company Ripple Labs has brought on a high-profile team from Debevoise & Plimpton—former Securities and Exchange Commission chair Mary Jo White and her enforcement chief Andrew Ceresney—to defend against a securities fraud lawsuit.

The Debevoise attorneys and lawyers from two California offices of Skadden, Arps, Slate, Meagher & Flom appear on court papers for Ripple on June 1, removing the suit from California state court to federal court in the Northern District of California.

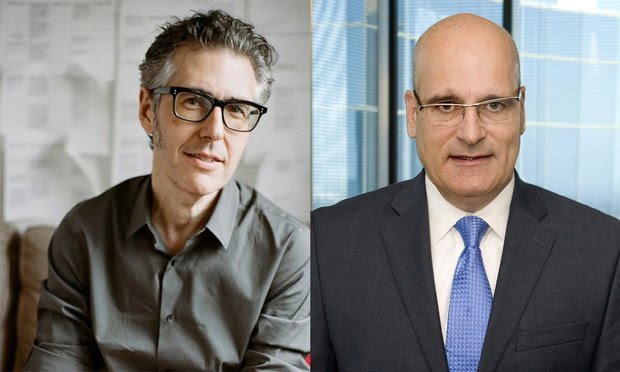

Mary Jo White and Andrew J. Ceresney

Mary Jo White and Andrew J. Ceresney