With the cannabis industry growing rapidly and an increasing number of states legalizing the federally outlawed drug, out-of-state market participants are trying to strike down certain aspects of state laws and regulations as violative of the dormant commerce clause. To that end, financial institutions looking to rely on new state regulations, which explicitly allow them to provide banking services to legal cannabis businesses, should be wary of whether such laws will themselves be found unconstitutional.

Since September 2022, the New York Office of Cannabis Management has been embroiled in litigation, stalling awards of new recreational retail marijuana licenses in five state regions, based upon allegations that the state licensing scheme violates the dormant commerce clause by favoring state residents over out-of-state operators. Similar suits making nearly identical claims have been filed against the cities of Los Angeles and Sacramento, California by companies affiliated with the same individual. Jonathan Capriel, “Michigander Says Court Should Block NY Pot Retail Licenses,” Law360 (Dec. 14, 2022 7:17 p.m.). The above cases come close on the heels of the recent decision by the U.S. Court of Appeals for the First Circuit finding that the Maine Medical Marijuana Act residency requirement violated the dormant commerce clause as facially protectionist in nature. See Northeast Patients Group v. United Cannabis Patients & Caregivers of Maine, 45 F.4th 542 (1st Cir. 2022). These are among a growing number of cases nationwide challenging state level cannabis regulations under the dormant commerce clause.

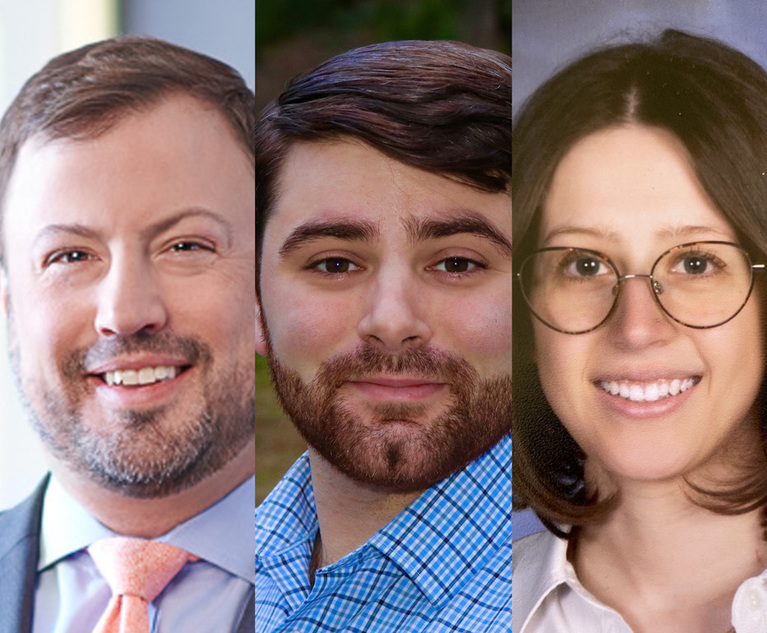

L-R: Nikolas S. Komyati, Patrick J. Medeo and Siena Carnevale of Bressler Amory & Ross

L-R: Nikolas S. Komyati, Patrick J. Medeo and Siena Carnevale of Bressler Amory & Ross