In its simplest form, the piercing of the corporate veil is an equitable remedy available to the creditors of corporate entities to request the court to hold their owners liable for the corporate debts. The underlying cause of action against the corporate entity could be a contract or tort action, none of which is attributable to its owners. For the creditors, the veil-piercing is desirable as their last resort to recover their damages while for the owners, it is detrimental as it exposes them to the type of liability that they wished to exonerate themselves from by forming a company in the first place. These two competing interests drive the forces behind the state laws on substantive elements and procedural requirements for veil-piercing: the more favorable the state policy is toward preserving limited liability, the harder it is under the state law for the court to disregard corporate entity, and the other way around. Pennsylvania law adopted a “strong presumption” against veil-piercing, see Stephen B. Presser, “Section 2:42.Pennsylvania, in Piercing the Corporate Veil,” (last updated July 2018).

Substantive Elements

Pennsylvania state and federal courts applying Pennsylvania law has long listed a vast set of factors that the court may consider in its decision to disregard the corporate shield, including, among others, using the corporate form as a sham to pursue fraudulent or illegal activities or to cause injustice, ignoring corporate formalities, undercapitalizing the company and exerting control to influence the corporate decisions and actions for personal interests. A combination of any number of these factors may convince the court that equity requires holding the owner personally liable for corporate debts, see, Good v. Holstein, 787 A.2d 426, 430 (Pa.Super. 2001); E. Minerals & Chemicals v. Mahan, 225 F.3d 330, 336 (3d Cir. 2000).

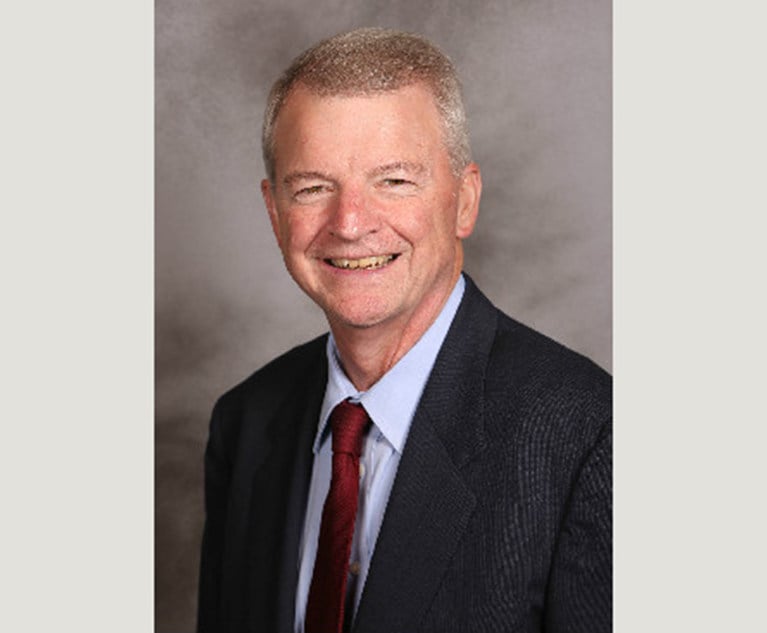

Edward T. Kang, Kang Haggerty & Fetbroyt

Edward T. Kang, Kang Haggerty & Fetbroyt