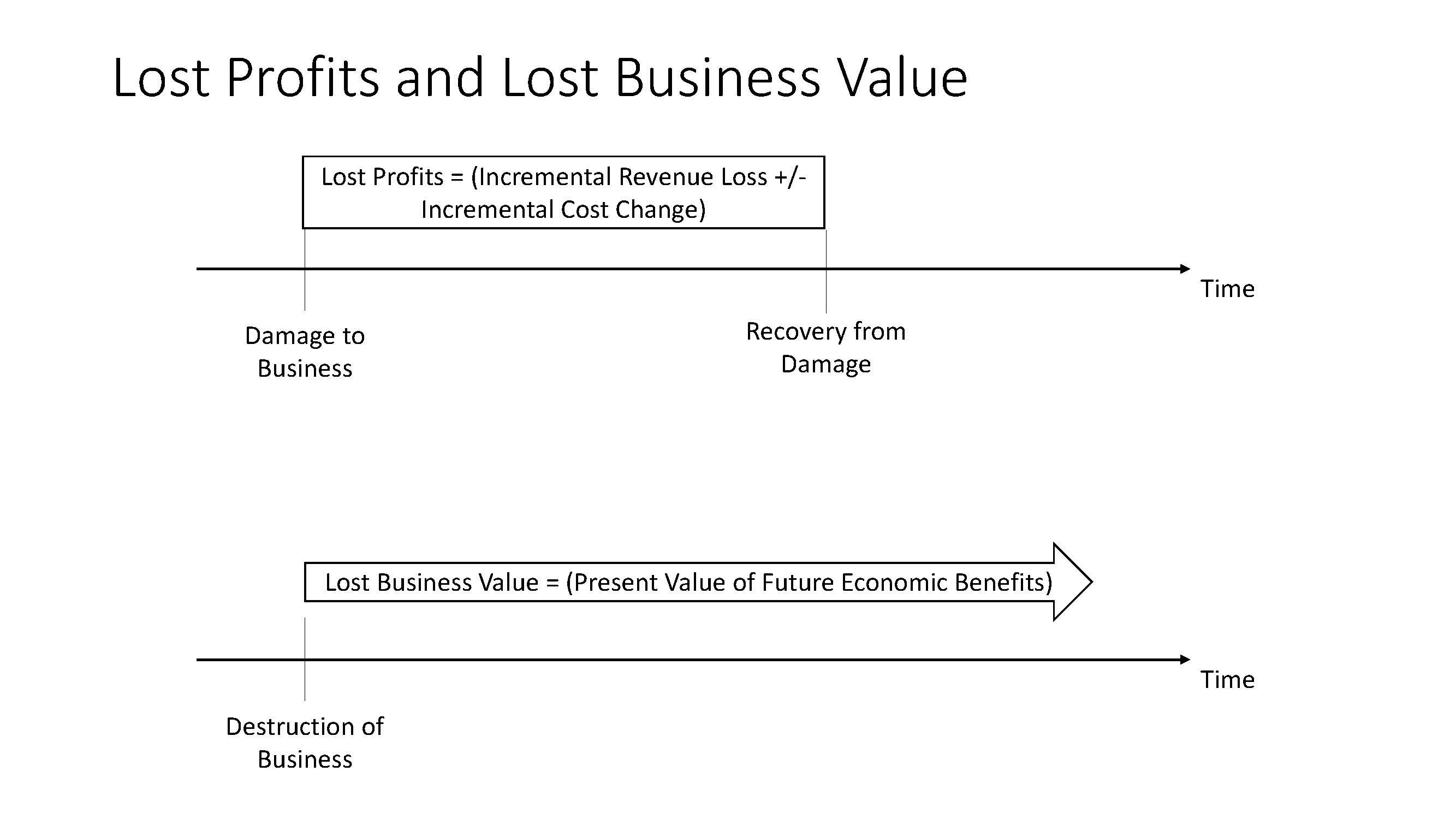

A business has a value equal to the expected future economic benefits to its owner, discounted to a present value. This concept has broad acceptance and appears in multiple economic, finance and valuation texts. See e.g. Damodaran, Aswath, Damodaran on Valuation. 2nd ed., (Hoboken, New Jersey: John Wiley & Sons, 2006) at p. 25. Although perhaps similar in concept and application, lost profits represent the incremental change in revenue attributable to a particular action, plus or minus the change in costs arising from that change in revenue (e.g. revenue declined by $10 due to the defendant’s wrongful action but costs declined by $3 due to the same action so the lost profits are $7). See AICPA Practice Aid 06-4, Calculating Lost Profits at ¶ 4. Lost profits must be related to the wrongful action of the defendant which becomes less certain over longer periods as other factors intercede. The diagram below shows the difference in the calculations:

Texas courts recognize the overlap between lost profits and loss in market value damages for businesses in tort and condemnation cases. Generally, lost profits is the proper measure of damages when a business’s activity has been temporarily harmed or interrupted. See Texas Instruments, Inc. v. Teletron Energy Mgmt., Inc., 877 S.W.2d 276 (Tex. 1994). The loss of a business’s market value (also referred to as diminution in value) is usually the proper measure of damages when a business has been destroyed. See Sawyer v. Fitts, 630 S.W.2d 872 (Tex. App.—Fort Worth 1982, no writ). They both account for a business’s profitability but in different circumstances.