Responsible investing has developed over the past 30 years, transforming to its current manifestation as a must-have capability for top-tier investment management firms. Environmental, Social and Governance (ESG) is a matrix, or a criteria, for assessing the impact of related practices of a business on its financial performance and operations.

Though the first generation of ESG investing was often associated with the belief that investments should align with moral and ethical values, responsible investing now looks to assess how environmental, social and governance issues can impact value of a business over the short and long term. Over the past five to 10 years, ESG criteria and data have gained increased attention across the investment industry; the United States and Europe, Middle East and Africa (EMEA) are beginning to see financings and loans tied to ESG matrices. ESG information disclosed through corporate sustainability reporting and survey responses is incorporated into assessments, tools, and analytics that inform mainstream investors’ responsibly investing strategies and products. ESG information is tied to positive price adjustments in financings and loans.

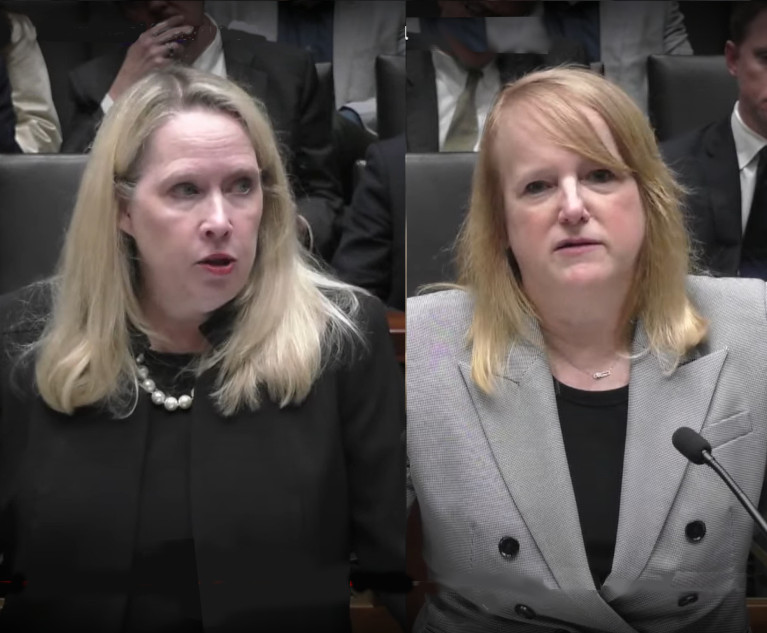

(L-R) Deanna Reitman of DLA Piper; Glenn Reitman of DLA Piper; Sonal Mahida, founder of Verability.

(L-R) Deanna Reitman of DLA Piper; Glenn Reitman of DLA Piper; Sonal Mahida, founder of Verability.