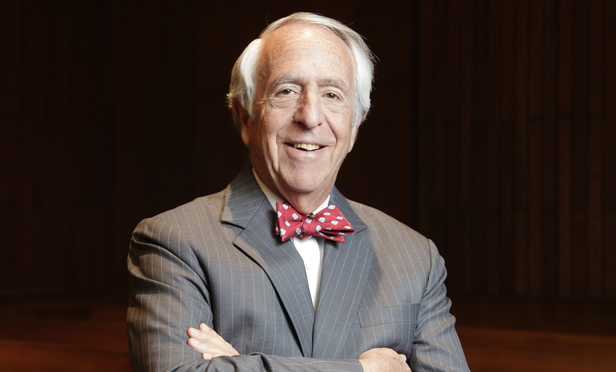

U.S. District Judge Charles Breyer, Northern District of California. (Photo: Hillary Jones-Mixon)

U.S. District Judge Charles Breyer, Northern District of California. (Photo: Hillary Jones-Mixon)

“Simply not appropriate.”

That’s what U.S. District Judge Charles Breyer had to say Wednesday about the $28.5 million fee request from plaintiffs firm Hagens Berman Sobol Shapiro for the work it led on the diesel emissions settlement between Volkswagen AG and its franchise dealers. Breyer slashed the request by nearly 90 percent, awarding just under $3 million in attorney fees.

Volkswagen, which paid $1.2 billion to settle the case, had protested the fee demand. In particular, the automaker accused managing partner Steve Berman of double counting billable hours that advanced both the dealer case and a separate diesel emissions case on behalf of consumers. Breyer, who presided over both cases in the Northern District of California, agreed.

“Dealer class counsel did not expend significant additional time procuring the settlement, nor did it undertake significant additional risk, given Volkswagen’s incentive to settle quickly,” the judge wrote in Wednesday’s order.

Berman did not respond to a request for comment, and a Volkswagen spokesman declined to comment.

After Berman sought fees in the dealer case, Volkswagen claimed that nearly half of his $3.5 million lodestar estimate—the amount of hours attorneys spent working on the case multiplied by their hourly billing rates—had already been counted in the $14.7 billion consumer settlement. In that case, Volkswagen had agreed not to contest $175 million in fees and expenses sought by 22 firms on the plaintiffs’ steering committee, one of which was Hagens Berman.

In essence, Volkswagen argued, Berman had already been paid for his work on the VW matters.

Steve Berman, Hagens Berman. (Photo: Jason Doiy/The Recorder)

Steve Berman, Hagens Berman. (Photo: Jason Doiy/The Recorder)

Berman had insisted that none of that mattered since his fee request was based not on hours worked but on a percentage of the fund, which turned out to be about 2 percent based on estimates that the fund could surpass $1.3 billion.

Breyer disagreed, citing the “unique circumstances leading to the settlement of this case.” He said much of the settlement’s “groundwork” had been laid in the consumer case, and Volkswagen had an incentive to settle the dealer case quickly in order to fix its cars. Berman had insisted that none of that mattered since his fee request was based not on hours worked but on a percentage of the fund, which turned out to be about 2 percent based on estimates that the fund could surpass $1.3 billion.

“These factors illuminate why a percentage method of calculating attorneys’ fees would overcompensate dealer class counsel for its work,” he wrote. Given the settlement’s large value, “even a modest percentage of the settlement would generate an outsized award of attorneys’ fees.”

After cutting the overlapping work, or “hybrid time,” from Berman’s lodestar amount, Breyer sliced another $560,000 in “reserve time” requested for future settlement work.

That left a revised lodestar of less than $1.5 million. Based on that amount, Berman’s fee request would require a multiplier of 19, which is “simply not appropriate here,” Breyer wrote. Instead, he doubled the lodestar, noting the swift settlement of the case and the risks that class counsel took.

In the end, Hagens Berman ended up with an award of $2.3 million in fees, though Breyer noted the firm also reaped $3.4 million from the consumer settlement. Bass Sox Mercer in Tallahassee, Florida, which worked with Hagens Berman on the dealer case, was awarded $622,000.

Amanda Bronstad covers mass torts and class actions for ALM. Contact her at [email protected]. On Twitter: @abronstadlaw