Editor’s Note: this is the final part of a three-part series looking at competition between elite US and UK firms. Part I presented evidence that the US elite has vanquished their UK counterparts and Part II examined how this victory came about.

Editor’s Note: this is the final part of a three-part series looking at competition between elite US and UK firms. Part I presented evidence that the US elite has vanquished their UK counterparts and Part II examined how this victory came about.

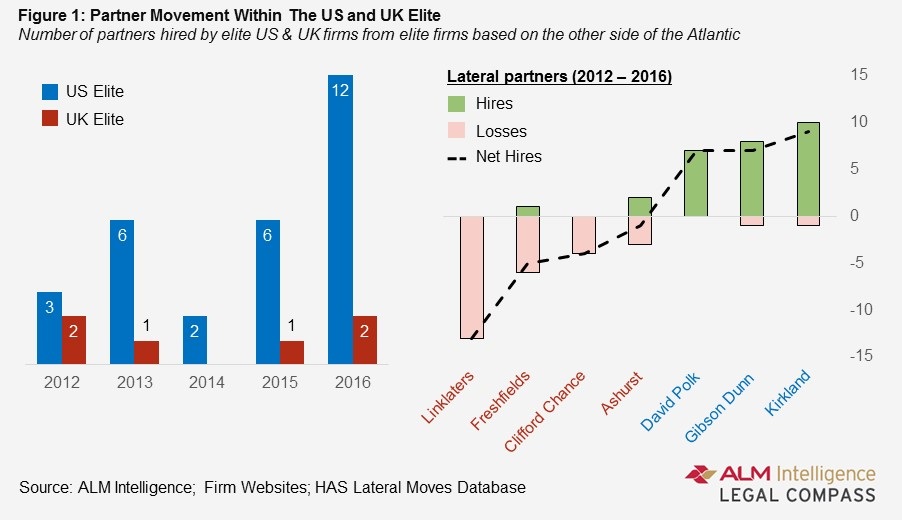

The US elite have distanced themselves significantly from their UK counterparts, as described in Parts I and II of this three-part series. They won the war for lateral talent, opened up a sizeable profitability gap, grew this gap significantly through the great recession, and have exhibited greater organizational growth and vitality, see Figures 1 and 2. The data suggest they are locking in their advantage as the phenomenon of increasing returns takes hold—this is, through the tendency for firms who are ahead to get further ahead as virtuous loops are established between attractive clients, great lawyers, and strong profits.

There are many salient lessons from this story for US law firms of all stripes. We don���t profess to have codified them all. However, in the hope they prompt more thought, discussion, and learning, we share a strawman distillation of these implications below.

There are many salient lessons from this story for US law firms of all stripes. We don���t profess to have codified them all. However, in the hope they prompt more thought, discussion, and learning, we share a strawman distillation of these implications below.

Lesson 1: Declines in market position can originate from small decisions

A firm can suffer a decline in market position without, say, a catastrophic merger or ill-advised lateral partner guarantees. A series of small decisions, none of which seem especially risky at the time, can aggregate to undermine significantly a firm���s profitability and hence its competitiveness. Hard thinking, and steadfast resolve, is required at all times.

Lesson 2: Growth is good, but profits matter more

Momentum in firm revenues is a nice-to-have; momentum in profitability is a must-have. There may be some commercially-successful partners who lateraled to a firm because it was growing faster; if there are, they are greatly outnumbered by those who left to a firm that could pay them more.

Lesson 3: Partner pay must reflect variation in economic value

As a firm's practices grow more diverse, either in terms of geographic focus or service offering, the economic value of partners��� practices necessarily diverges. A firm���s compensation system must evolve in real time to ensure individual partners��� compensation is aligned with the widening economic value. Failure to do so yields under-payment (relative to economic value) of the most commercially-productive partners.�� This heightens the risk of these partners departing to firms more willing to compensate them commensurately with their economic worth.

Lesson 4: Corporate portfolio models don���t apply to law firms

Firm leaders should internalize that typical corporate models of investment and growth are dangerous to apply to law firms. At a corporation, ���cash cow��� businesses can generate large amounts of free cash flow practically in perpetuity. Corporate leaders can redeploy this cash to invest in new ventures in the hope of creating future cash cows. However, at law firms, free cash flow only exists if a partner is being paid below the economic value of her practice. This can happen only rarely, briefly, and to a small degree, before the risk of high-value partners departing becomes intolerable. No cash cows, low investment capacity.

Lesson 5: Global office networks are not, by themselves, a differentiator

Having a differentiated offering only matters if what���s different about the offering is something the client could not otherwise readily replicate. For example, a client offering that entails services from a firm���s lawyers housed across a global network of offices may be differentiated in the sense that few firms could provide the service in this way. However, if what results for the client is not meaningfully better than that which could be secured by their primary law firm engaging independent counsel across the same array of locations, then there is no benefit to the client from the global firm���s footprint. Indeed, there could be a cost to the client if the global firm���s fealty to the lawyers in its office network results in the client not accessing the best-of-breed lawyer in a particular jurisdiction.

Lesson 6: Global office networks have to be tightly integrated to create value

Competitive advantage only accrues from a global office footprint if it is used to create offerings that are truly distinct and valuable to clients.�� Such offerings do not result from cross selling (the law firm equivalent of a fast food upsell, i.e. do you want fries with that?) which adds ���volume��� for the law firm but doesn���t add ���value��� for either the client or the law firm. Rather, distinct and valuable offerings are created when lawyers with different backgrounds work together in ways that wouldn���t happen if they worked across firm boundaries and that lead the lawyers to integrate their separate expertise in ways that bring forth novel, or streamlined, solutions. Such integration is typically most fruitful when focused on emerging legal specialties and at the intersection of existing practice area definitions. It���s stunningly difficult to pull off this level of integration at law firms. It requires enablement, example setting, and relentless encouragement from firm leadership. It also requires dogged, activist, client-teaming and practice-management overlays to a firm���s office-centered organizational structure.

Lesson 1: Declines in market position can originate from small decisions

A firm can suffer a decline in market position without, say, a catastrophic merger or ill-advised lateral partner guarantees. A series of small decisions, none of which seem especially risky at the time, can aggregate to undermine significantly a firm���s profitability and hence its competitiveness. Hard thinking, and steadfast resolve, is required at all times.

Lesson 2: Growth is good, but profits matter more

Momentum in firm revenues is a nice-to-have; momentum in profitability is a must-have. There may be some commercially-successful partners who lateraled to a firm because it was growing faster; if there are, they are greatly outnumbered by those who left to a firm that could pay them more.

Lesson 3: Partner pay must reflect variation in economic value

As a firm's practices grow more diverse, either in terms of geographic focus or service offering, the economic value of partners��� practices necessarily diverges. A firm���s compensation system must evolve in real time to ensure individual partners��� compensation is aligned with the widening economic value. Failure to do so yields under-payment (relative to economic value) of the most commercially-productive partners.�� This heightens the risk of these partners departing to firms more willing to compensate them commensurately with their economic worth.

Lesson 4: Corporate portfolio models don���t apply to law firms

Firm leaders should internalize that typical corporate models of investment and growth are dangerous to apply to law firms. At a corporation, ���cash cow��� businesses can generate large amounts of free cash flow practically in perpetuity. Corporate leaders can redeploy this cash to invest in new ventures in the hope of creating future cash cows. However, at law firms, free cash flow only exists if a partner is being paid below the economic value of her practice. This can happen only rarely, briefly, and to a small degree, before the risk of high-value partners departing becomes intolerable. No cash cows, low investment capacity.

Lesson 5: Global office networks are not, by themselves, a differentiator

Having a differentiated offering only matters if what���s different about the offering is something the client could not otherwise readily replicate. For example, a client offering that entails services from a firm���s lawyers housed across a global network of offices may be differentiated in the sense that few firms could provide the service in this way. However, if what results for the client is not meaningfully better than that which could be secured by their primary law firm engaging independent counsel across the same array of locations, then there is no benefit to the client from the global firm���s footprint. Indeed, there could be a cost to the client if the global firm���s fealty to the lawyers in its office network results in the client not accessing the best-of-breed lawyer in a particular jurisdiction.

Lesson 6: Global office networks have to be tightly integrated to create value

Competitive advantage only accrues from a global office footprint if it is used to create offerings that are truly distinct and valuable to clients.�� Such offerings do not result from cross selling (the law firm equivalent of a fast food upsell, i.e. do you want fries with that?) which adds ���volume��� for the law firm but doesn���t add ���value��� for either the client or the law firm. Rather, distinct and valuable offerings are created when lawyers with different backgrounds work together in ways that wouldn���t happen if they worked across firm boundaries and that lead the lawyers to integrate their separate expertise in ways that bring forth novel, or streamlined, solutions. Such integration is typically most fruitful when focused on emerging legal specialties and at the intersection of existing practice area definitions. It���s stunningly difficult to pull off this level of integration at law firms. It requires enablement, example setting, and relentless encouragement from firm leadership. It also requires dogged, activist, client-teaming and practice-management overlays to a firm���s office-centered organizational structure.

Nicholas Bruch is a Senior Analyst at ALM Legal Intelligence. His experience includes advising law firms and law departments in developing and developed markets on issues related to strategy, business development, market intelligence, and operations. He can be reached by

Nicholas Bruch is a Senior Analyst at ALM Legal Intelligence. His experience includes advising law firms and law departments in developing and developed markets on issues related to strategy, business development, market intelligence, and operations. He can be reached by  Hugh A. Simons is an ALM Intelligence Fellow. He is a former senior partner and executive committee member at The Boston Consulting Group and the former chief operating officer at Ropes & Gray. He is currently conducting research for a book on the fundamentals of elite law firm strategy.He can be reached by

Hugh A. Simons is an ALM Intelligence Fellow. He is a former senior partner and executive committee member at The Boston Consulting Group and the former chief operating officer at Ropes & Gray. He is currently conducting research for a book on the fundamentals of elite law firm strategy.He can be reached by