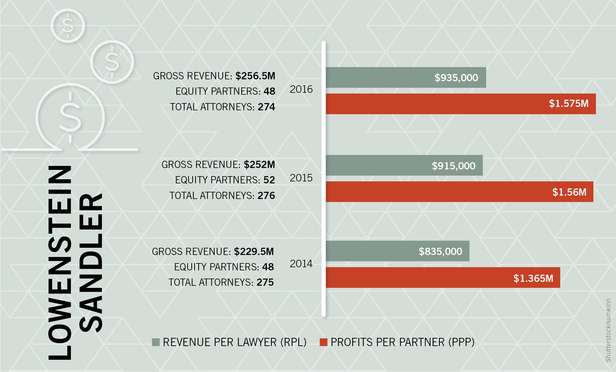

Lowenstein Sandler saw incremental increases in gross revenue and average equity partner compensation in 2016, while attorney head count stayed essentially flat.

The Roseland-based firm’s $256.5 million gross revenue last year was a 1.8 percent increase over the $252 million total from 2015.