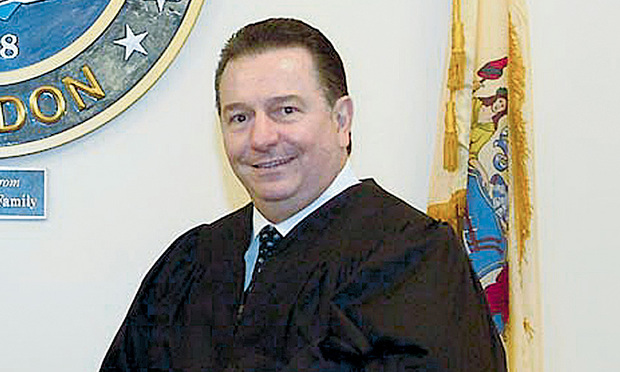

Longtime Municipal Court Judge Harold P. Cook III, who once sat in four Passaic County, N.J., municipalities—Haledon, North Haledon, Ringwood and Wanaque—was censured by the N.J. Supreme Court on July 18 and permanently banned from the bench.

The court acted on a May 1 presentment from the Advisory Committee on Judicial Conduct, which found “egregious misconduct that seriously weakens the public’s confidence in the integrity and independence of the judiciary, and demonstrates a disturbing lack of good judgment.”