On Dec. 22, 2017, P.L. 115-97 (commonly known as the Tax Cuts and Jobs Act) was signed into law, enacting the biggest set of changes to the Internal Revenue Code since 1986. One of the most important provisions of the act for real estate owners is new Section 199A, which (subject to certain important limitations) allows individuals, trusts, and estates a deduction equal to up to 20 percent of certain qualified business income. This effectively reduces the top marginal tax rate on qualified business income from 37 percent to approximately 30 percent. Although this is a very favorable provision for the real estate industry, there are several areas of uncertainty.

In general, Section 199A provides that ordinary income from a trade or business is eligible for the deduction, whether it is derived from a partnership, LLC, S corporation, or sole proprietorship. However, income from certain types of businesses generally do not qualify for the deduction. Among these non-qualifying businesses are service businesses such as health, law, accounting, actuarial science, performing arts, consulting, athletics, financial services, brokerage services, or any trade or business “where the principal asset of such trade or business is the reputation or skill” of one or more of its owners or employees. Also excluded are businesses involving “the performance of services that consist of investing and investment management, trading, or dealing in securities, partnership interests, or commodities.”

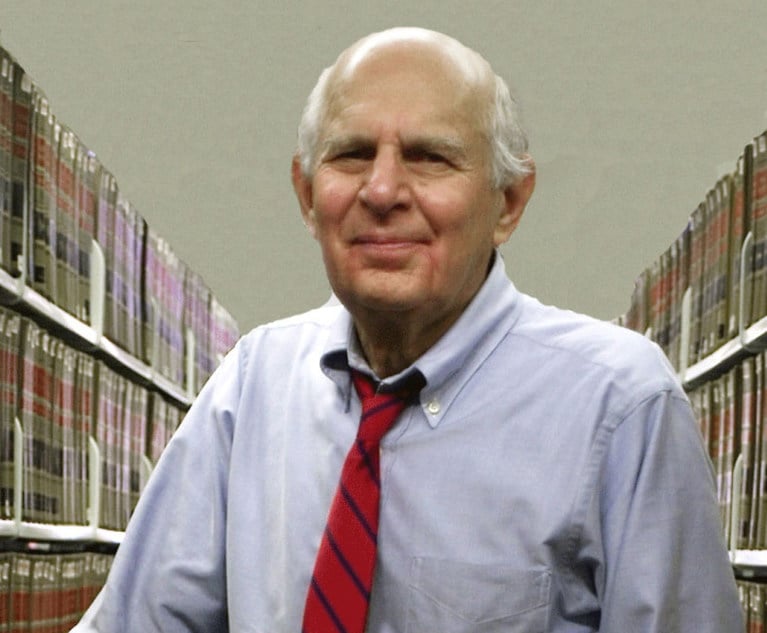

Ezra Dyckman and Charles S. Nelson

Ezra Dyckman and Charles S. Nelson