A Co-op cannot evict two shareholders over unpaid maintenance and electric bills because the co-op could not show how the building’s maintenance charges were determined, a Manhattan housing court judge ruled.

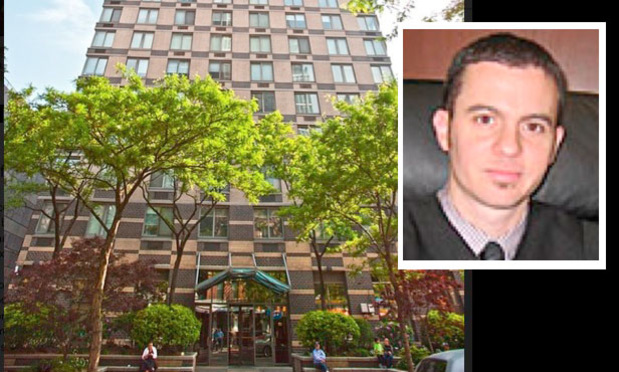

Judge Jack Stoller (See Profile) ruled Thursday that the Upper East Side Co-op’s summary proceeding against the shareholders, Frieda and Howard Dropkin, must be dismissed because the co-op, 300 East 85th Housing Corp., had offered no evidence of how its maintenance charges, or the Dropkins’ share of them, were calculated.