SAN FRANCISCO – A federal judge in San Francisco has ruled the Heller Ehrman bankruptcy estate has no claim to profits earned from client business former partners brought with them to new law firms.

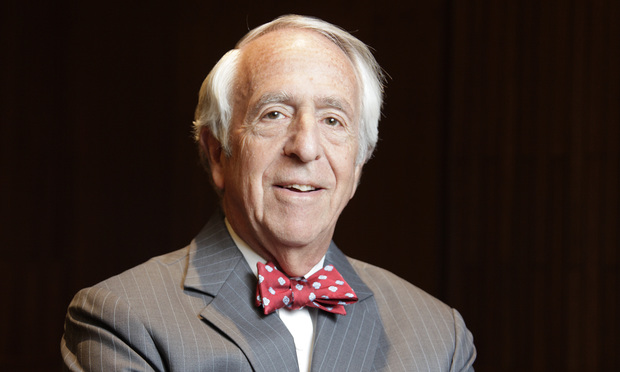

In a 13-page order issued Wednesday, U.S. District Judge Charles Breyer sided with firms such as Orrick, Herrington & Sutcliffe and Jones Day that fought clawback actions after hiring Heller partners. Breyer expressed concern that the estate’s campaign to recover fees threatened clients’ rights.